As filed with the Securities and Exchange Commission on June 7, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LESLIE’S, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 5091 | 20-8397425 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2005 East Indian School Road

Phoenix, Arizona 85016

(602) 366-3999

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Brad A. Gazaway

Chief Legal Officer

Leslie’s, Inc.

2005 East Indian School Road

Phoenix, Arizona 85016

(602) 366-3999

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jennifer Bellah Maguire Gibson, Dunn & Crutcher LLP 333 South Grand Avenue Los Angeles, CA 90071 (213) 229-7242 |

Marc D. Jaffe Scott W. Westhoff Latham & Watkins

LLP |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☐ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Per Unit(2) |

Proposed Maximum Offering Price(1)(2) |

Amount of Registration Fee | ||||

| Common Stock, $0.001 par value per share | 28,175,000 | $29.92 | $842,996,000 | $91,970.86 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 3,675,000 shares of common stock that the underwriters have the option to purchase. See “Underwriting.” |

| (2) | Estimated solely for the purpose of calculating the registration fee under Rule 457(c) of the Securities Act of 1933, as amended, based on the average of the high and low prices of a share of common stock on The Nasdaq Global Select Market on June 4, 2021, which was $29.92. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion,

Preliminary Prospectus dated June 7, 2021

PROSPECTUS

24,500,000 Shares

Common Stock

$ per share

The selling stockholders identified in this prospectus are offering 24,500,000 shares of our common stock. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders.

Our common stock is listed on The Nasdaq Global Select Market (“Nasdaq”) under the symbol “LESL.” On June 4, 2021, the last reported sales price of a share of our common stock on Nasdaq was $29.76.

Investing in our common stock involves risks. See the section titled “Risk Factors,” beginning on page 17 for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to the selling stockholders, before expenses |

$ | $ | ||||||

| (1) | See the section titled “Underwriting” for a description of compensation payable to the underwriters and estimated offering expenses. |

The underwriters may also exercise their option to purchase up to an additional 3,675,000 shares from the selling stockholders at the public offering price less the underwriting discount for 30 days after the date of this prospectus.

The shares will be ready for delivery on or about , 2021.

| Goldman Sachs & Co. LLC | Morgan Stanley | BofA Securities |

| Jefferies | Nomura | |

| Baird | Guggenheim Securities | Piper Sandler | William Blair | Stifel | ||||

| Telsey Advisory Group | Loop Capital Markets | AmeriVet Securities | Ramirez & Co., Inc. | |||

The date of this prospectus is , 2021.

| Page | ||||

| 1 | ||||

| 14 | ||||

| 17 | ||||

| 21 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 28 | ||||

| 33 | ||||

| CERTAIN MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS |

35 | |||

| 40 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

You should rely only on the information contained in this prospectus or in any related free-writing prospectus prepared by or on behalf of us. We, the selling stockholders and the underwriters have not authorized anyone to provide you with information different from, or in addition to, the information contained in this prospectus or in any related free-writing prospectus. The information contained in this prospectus is current only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the shares of common stock.

We, the selling stockholders and the underwriters have not taken any action that would permit a public offering of the shares of common stock outside the United States or permit the possession or distribution of this prospectus or any related free-writing prospectus outside the United States. Persons outside the United States who come into possession of this prospectus or any related free-writing prospectus must inform themselves about and observe any restrictions relating to the offering of the shares of common stock and the distribution of the prospectus outside the United States.

i

Trademarks

Leslie’s®, AccuBlue®, MyLife®, and other trademarks, trade names or service marks of Leslie’s, Inc. appearing in this prospectus are the property of Leslie’s, Inc. All other trademarks, trade names, and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, the trademarks and trade names in this prospectus may be referred to without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the rights of the applicable licensor to these trademarks and tradenames.

Market, Ranking, and Other Industry Data

In this prospectus, we refer to information regarding industry, market, and competitive position data that we obtained from our own internal estimates and research, as well as from independent market research, industry and general publications and surveys, governmental agencies, and publicly available information in addition to research, surveys, and studies conducted by third parties. In some cases, we do not expressly refer to the sources from which this data is derived. In that regard, when we refer to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from the same sources, unless otherwise expressly stated or the context otherwise requires. All of the market and industry data used in this prospectus involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such assumptions and limitations.

In addition, while we believe the industry, market, and competitive position data included in this prospectus is reliable and based on reasonable assumptions, such data involve risks and uncertainties and are subject to change based on various factors, including those described in the section titled “Risk Factors” included elsewhere in this prospectus and in the section titled “Risk Factors” included in our Annual Report on Form 10-K for the year ended October 3, 2020, our Quarterly Report on Form 10-Q for the quarter ended January 2, 2021 and our Quarterly Report on Form 10-Q for the quarter ended April 3, 2021, which are incorporated by reference herein. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties or by us.

Non-GAAP Financial Measures

Comparable sales, comparable sales growth, adjusted EBITDA, adjusted net income and adjusted net income per share are our key non-GAAP financial measures. For more information about how we use these non-GAAP financial measures in our business, the limitations of these measures, and a reconciliation of these measures to the most directly comparable GAAP measures, please see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations––Key Factors and Measures We Use to Evaluate Our Business” included in our Quarterly Report on Form 10-Q for the quarter ended April 3, 2021, which is incorporated by reference herein.

ii

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before deciding to purchase our common stock in this offering. You should read the entire prospectus carefully, including the section titled “Risk Factors” included elsewhere in this prospectus and the sections titled “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes included in our Annual Report on Form 10-K for the year ended October 3, 2020, our Quarterly Report on Form 10-Q for the quarter ended January 2, 2021 and our Quarterly Report on Form 10-Q for the quarter ended April 3, 2021, which are incorporated by reference herein, before making an investment decision. If you invest in our common stock, you are assuming a high degree of risk.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “we,” “our,” “us,” “Leslie’s,” “the Company,” and “our Company” refer to Leslie’s, Inc. and its consolidated subsidiaries.

Our Business

Our Company

We are the largest and most trusted direct-to-consumer brand in the $11 billion United States pool and spa care industry, serving residential, professional, and commercial consumers. Founded in 1963, we are the only direct-to-consumer pool and spa care brand with national scale, operating an integrated marketing and distribution ecosystem powered by a physical network of 945 branded locations and a robust digital platform. We command a market-leading share of nearly 15% of residential aftermarket product spend as of 2020, which represents an increase of approximately 600 basis points since 2010, our physical network is larger than the sum of our twenty largest competitors, and our digital sales are estimated to be greater than five times as large as that of our largest digital competitor. We offer an extensive assortment of professional-grade products, the majority of which are exclusive to Leslie’s, as well as certified installation and repair services, all of which are essential to the ongoing maintenance of pools and spas. Our dedicated team of associates, pool and spa care experts, and experienced service technicians are passionate about empowering our consumers with the knowledge, products, and solutions necessary to confidently maintain and enjoy their pools and spas. Over the last five fiscal years, we have spent more than $70 million in foundational investments across new technologies and capabilities focused on transforming our consumer experience and advancing our industry leadership. The unprecedented scale of our integrated marketing and distribution ecosystem, which is powered by our direct-to-consumer network, uniquely enables us to efficiently reach and service every pool and spa in the continental United States—capabilities no competitor can match.

1

The aftermarket pool and spa care industry is one of the most fundamentally attractive consumer categories given its scale, predictability, and growth outlook. Since 1970, when industry market data was first collected, the market has demonstrated consistent growth due to the non-discretionary nature of ongoing water treatment to maintain safe, sanitized water. Without proper ongoing maintenance, water quality quickly degrades, yielding unsafe conditions and risking equipment failure. As a result, each pool and spa represents an annuity-like stream of chemical, equipment, and service revenue for their average life span of over 25 years. We estimate the average in-ground pool owner spends $24,000 or more on maintenance products and services over the life of a pool. According to P.K. Data, the United States market is comprised of a growing installed base of more than 14 million pools and spas, and the installed base of residential in ground pools has grown every year for at least 50 years. The industry generated over $11 billion in estimated revenue during 2020 and grew at an estimated 5.1% CAGR from 2015 to 2020.

The industry is currently experiencing a significant increase in demand, as the COVID-19 pandemic has accelerated secular trends in consumer behavior. Consumers are increasingly focused on outdoor living, healthy lifestyles, sanitization and safety, migrating to lower density communities, and spending more time at home, all of which are fundamentally changing their spending patterns. In particular, the stay-at-home reality of the pandemic has led to significant growth in new pool installations and pool usage. Based on research performed by P.K. Data, new pool installations grew by 23% in 2020. This significant increase in new pool construction activity represents a permanent increase in demand for aftermarket products and services. Over 200,000 new in ground pools are expected to be constructed in 2021 and 2022, representing over $5 billion in estimated lifetime maintenance spend. While our business is not dependent on new pool construction, we believe we are uniquely positioned to capture a meaningful portion of the related aftermarket spend.

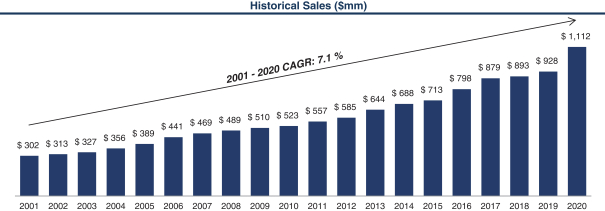

Given we play primarily in the aftermarket business, we have a highly predictable, recurring revenue model, as evidenced by our 57 consecutive years of sales growth. Approximately 80% of our assortment is comprised of non-discretionary products essential to the care of residential and commercial pools and spas. Our assortment includes chemicals, equipment and parts, cleaning and

2

maintenance equipment, and safety, recreational, and fitness-related products. We also offer important, essential services, such as equipment installation and repair for residential and commercial consumers. Consumers receive the benefit of extended vendor warranties when purchasing product through our locations or when our certified in-field technicians install or repair equipment on-site. We also offer complimentary, commercial-grade, in-store water testing and analysis via our proprietary AccuBlue® system, which increases consumer engagement, conversion, basket size, and loyalty, resulting in higher lifetime value. Our water treatment expertise is powered by data and intelligence accumulated from the millions of water tests we have performed over our history, positioning us as the most trusted water treatment solutions provider in the industry. Due to the non-discretionary nature of our products and services, our business has historically delivered strong, uninterrupted growth and profitability in all market environments, including the Great Recession and the COVID-19 pandemic. Our growth has recently accelerated with sales growth of 19.8% for fiscal year 2020 and sales growth of 35.3% for the first 26 weeks of fiscal year 2021 when compared to the prior year periods.

57 Years of Leadership and Disruptive Innovation in Pool & Spa Care

Since our founding in 1963, we have been the leading innovator in our category and have provided our consumers with the most advanced pool and spa care available. As we have scaled, we have leveraged our competitive advantages to strategically reinvest in our business and intellectual property to develop new, value-added capabilities that allow us to meet the needs of any pool and spa owner, whether they care for their pool or spa themselves or rely on a professional, whatever the nature of their need may be, and however they wish to engage with us.

Legacy of Innovation

Over our 57-year history, we have introduced innovative ways to serve pool and spa owners and the professionals who care for their pools and spas.

Owned and Exclusive Brands. Since our inception in 1963, we have offered a portfolio of owned and exclusive brands. We continue to expand our selection of exclusive offerings through innovation, most recently with the launch of the Jacuzzi® and our RightFit® brands in 2016. Our exclusive brands and products account for approximately 55% of total sales and 80% of chemical sales. These proprietary brands and custom-formulated products are only available through our integrated platform and offer professional-grade quality to our consumers, while allowing us to achieve higher gross margins relative to sales of third-party products.

3

Complimentary and Proprietary Water Testing. We pioneered complimentary in-store water testing, and over the course of our history have conducted over 40 million tests, which has helped us establish relationships, cultivate loyalty, and drive attractive lifetime value with our consumers as they rely on us for their water treatment needs. We have found that consumers who regularly test their water with us spend more with us per year than other consumers, and we believe that these consumers experience significantly fewer days where their pools are out of commission.

Complimentary In-Store Repair. We provide complimentary in-store equipment repair, which we offer to all consumers with the purchase of Leslie’s replacement parts. Over the last fifteen years, we have conducted more than one million in-store repairs.

In-Field Services. We employ the industry’s largest in-field service network, consisting of more than 200 pool and spa care service professionals who have the expertise to provide essential, on-site equipment installation and repair services for residential and commercial consumers throughout the continental United States.

Loyalty Program. In 2014, we launched the industry’s first loyalty program, which helps track loyalty members’ water treatment history and prescriptions and rewards them for shopping with us. As of October 3, 2020, our loyalty program has more than 3.3 million members, up more than 50% from 2.1 million active members as of September 2018. Our loyalty members spend twice as much with us on average compared to our other consumers. In May 2021, we launched our updated loyalty program, Pool Perks, in order to offer more value-added features to further drive member enrollment and engagement.

Professional Market. In 2015, we made the strategic decision to resource this channel and accelerate sales growth to professional consumers. Through acquisitions, technology investments, and increased utilization of our integrated network we drove a sales CAGR of over 20% through fiscal year 2020. Our differentiated go-to-market model includes 945 convenient locations, including dedicated Leslie’s PRO locations in certain markets, extended operating hours, expansive product offering through our online platforms, multiple fulfillment capabilities, and the ability to provide pool professionals with referrals to residential consumers. Despite our strong growth, our penetration in the professional market remains modest with an estimated market share of less than 10%.

Leslie’s Evolution in the Digital World

Over the last five years, we have spent more than $70 million investing in new service offerings and digital capabilities that have modernized how consumers take care of their pools and spas.

Digital Network. We have built the largest digital presence in the industry. Our complementary platform of branded proprietary e-commerce websites and marketplace storefronts allows us to seamlessly serve the needs of all digital consumers through curated pricing and targeted merchandising strategies. In addition to our owned e-commerce websites, approximately 40% of our digital sales take place through online marketplaces. In all, our digital network is strategically designed to maximize total profitability. Our digital sales have grown at a CAGR of more than 35% between fiscal year 2015 and fiscal year 2020, and represented 26% of our total sales in fiscal year 2020, up from 8% in fiscal year 2015.

Mobile App. In 2018, we introduced a custom-designed mobile app that allows consumers to create a personalized pool profile, sync in-store prescriptions, and monitor the performance of at-home water tests. As of April 2021, the mobile app had more than one half million downloads and an average user rating of 4.6/5.0. We plan to continue enhancing this critical element of our network by introducing new features, including transaction capabilities.

4

Consumer-Centric Integrated Ecosystem. We architected a consumer-centric integrated ecosystem comprised of our physical network of 945 branded locations and a robust, data-driven digital platform. Over the last two years, we have invested in new capabilities, including global inventory visibility, buy online pick-up in store (“BOPIS”), buy online return in store (“BORIS”), and ship from store (“SFS”), all of which were introduced in 2021. With our integrated physical and digital network, we will have the unique advantage of being able to reach all consumers in the continental United States in less than 24 hours, whether they are homeowners, pool and spa professionals, or commercial pool operators, whenever, wherever, and however they prefer to shop.

AccuBlue® Water Testing & Prescription Service. In January 2020, we launched our AccuBlue® in-store water testing device and enhanced water testing experience. AccuBlue®, which features exclusive and proprietary software that incorporates our 57 years of accumulated water treatment expertise, automates and gamifies the water testing experience, driving enhanced accuracy, higher throughput, greater consumer engagement, and increased consumer adherence to prescription recommendations. Locations that have been equipped with AccuBlue® are growing sales at a faster rate than our other locations, supported by an increase in number of water tests performed, an improved conversion rate, and an increase in number of products prescribed per test which has resulted in greater units per transaction. In December 2020, we completed the rollout of AccuBlue® across our physical network.

Highly Experienced and Visionary Management Team. Over the last five years, we have built a diverse, multi-disciplinary management team to drive our consumer-first, digitally enabled growth. Since 2018, four of our eight senior leaders have joined our organization, bringing new expertise and capabilities that are highly complementary and synergistic with our core industry expertise that we have accumulated over decades.

Innovating the Future of Pool and Spa Care

As we look forward, we are committed to better serving our digital-first consumer by introducing an expanded portfolio of connected pool and spa products and services. We believe that we are uniquely positioned to leverage our market-leadership to continue to disrupt the pool and spa care category and further distance ourselves from our competition.

AccuBlue HomeTM Subscription. We are actively developing new technologies that seek to fundamentally change the way all consumers, whether a novice or an expert, care for their pools and spas. Through a new AccuBlue HomeTM subscription offering, we will leverage our proprietary water diagnostics software to convert on-demand test results into actionable prescriptions and treatment plans tailored to the specific size and conditions of a consumer’s pool or spa, which we can seamlessly and automatically fulfill through our integrated network.

Certified Pool Maintenance Offering. We are assembling a strategic network of qualified pool professionals to extend the Leslie’s brand into on-site water maintenance, completing our suite of service offerings in the residential pool ecosystem.

Ongoing R&D. We continue to leverage our intellectual property and differentiated strategic position to be the innovator and disruptor in our industry. We plan to strategically reinvest in our business and bring to market new products and services that will continue to improve our ability to serve our consumers and win in the marketplace. In addition to our internal efforts, as the most recognized and trusted authority in the industry with the most direct access and deepest relationships with pool and spa owners, we continue to receive unsolicited opportunities from third parties to introduce to the market and commercialize new products and services on an exclusive basis.

5

Our Competitive Strengths

We believe that the following competitive strengths have been key drivers of our success to date, and strategically position us for continued success.

Undisputed direct-to-consumer market leader in the aftermarket pool and spa care industry.

For 57 years, we have been dedicated to addressing our consumers’ pool needs so they can spend less time maintaining and more time enjoying their pools. We are the only direct-to-consumer pool and spa care brand with a nationwide physical presence and an integrated digital platform, consisting of individually merchandised e-commerce websites, a mobile app with transaction capabilities, and online marketplace operations, is designed to address the needs of all pool and spa consumers. The remainder of the industry is highly fragmented across both offline and online providers. We command a market-leading share of nearly 15% of residential aftermarket product spend, which represents an increase of approximately 600 basis points since 2010, our physical network is larger than the sum of the next twenty largest competitors, and our digital sales are estimated to be greater than five times as large as that of our largest digital competitor. Additionally, we estimate our share of digital sales to be greater than 60%.

We believe that our history, scale, and consumer-centric approach have contributed to industry-leading consumer affinity metrics. As a result of our consumer-centric approach, we have a Voice of Customer (VoC) score of approximately 73% based on our regular surveys of our consumer file, which demonstrates our consumers’ strong affinity for our brand.

Direct relationships with more than 11 million pool and spa owners and professionals, generating durable, annuity-like economics.

We are the largest national pool and spa care brand that has a direct relationship with pool and spa owners and the professionals who serve them. Across our integrated platform, we have a total file of approximately 11 million consumers. Through our team of highly trained pool and spa experts, we offer sophisticated product recommendations and other expert advice, which cultivates long-standing relationships with our consumers. The comprehensive nature of our product and service offering eliminates the need for consumers to leave the Leslie’s ecosystem, driving exceptional retention with annuity-like economics.

In 2014, we launched our loyalty membership program to further deepen our consumer relationships. The program, which serves more than 3.3 million consumers, allows members to save, earn, and redeem via discounts, points, and rewards. We track consumer preferences, order frequency, and pool profiles in order to curate and enhance our recommendations and promotions, anticipate product demand, and track lifetime value to better incentivize our loyalty members. On average, a loyalty member spends twice as much with us per year than a non-loyalty member.

Consumer-centric connected ecosystem for all pool and spa owners and the professionals who serve them using proprietary, leading brands across all channels.

We have built the most extensive and geographically diverse pool and spa care network in the United States, consisting of three formats: Residential, Professional (PRO), and Commercial. Our locations are strategically located in densely populated areas mainly throughout the Sunbelt, including California, Arizona, Texas, and Florida. Across our physical network, we employ a team of over 4,000 associates, including pool and spa care experts and service technicians, who act as solution providers

6

to all of our consumers, including both do-it-yourself (“DIY”) and do-it-for-me (“DIFM”) pool owners as well as pool professionals.

| • | Residential Locations. We serve our residential consumers through 901 residential locations that are strategically located in 38 states. Our residential locations have on average 900 in-store SKUs. |

| • | PRO Locations. Our 27 PRO locations carry a broadened assortment of approximately 1,500 SKUs targeting the professional consumer. These locations also serve residential and commercial consumers. |

| • | Commercial Service Centers. We serve our commercial consumers through 17 Commercial Service Centers. These are our largest format locations with an extensive assortment including over 350 bulk SKUs and special items and services. |

As the world has become more digitally focused, and consumers increasingly demand “smart” home-enabled options, we have focused on architecting the industry-leading integrated digital platform of proprietary e-commerce websites designed to serve our residential, professional, and commercial consumers. Our proprietary e-commerce websites serve digital consumers through curated pricing and targeted merchandising strategies. In addition to our owned e-commerce websites, we offer our products through online marketplaces such as Amazon, eBay, and Walmart. As a result of our strategic investments in digital, we are uniquely positioned to serve our consumers with cross-channel capabilities and capture incremental online demand from new consumers while growing the total profitability of the network.

Comprehensive assortment of proprietary brands with recurring, essential, superior product formulations, and trusted, solution-based services for all consumers.

We offer a comprehensive product assortment, consisting of more than 30,000 products across chemicals, equipment and parts, cleaning and maintenance equipment, and safety, recreational, and fitness-related categories. Approximately 80% of our product sales are non-discretionary and recurring in nature. In fiscal year 2020, chemicals and equipment & parts accounted for approximately 45% and 30% of our total sales, respectively. These products are critical to the ongoing maintenance of pools and spas. In addition, approximately 55% of our total sales and 80% of our chemical sales are derived from proprietary brands and custom-formulated products, which allows us to create an entrenched consumer relationship, control our supply chain, and capture attractive margins. Consumers choose our exclusive, proprietary brands and custom-formulated products for their efficacy and value, a combination that we believe cannot be found elsewhere.

We pair our comprehensive product assortment with differentiated in-store and on-site service offerings. We pioneered the complimentary in-store water test and resulting pool or spa water prescription, which has driven consumer traffic and loyalty, and has created a “pharmacist-like” relationship with our consumers. Through innovation, we recently introduced significant upgrades to our water testing capabilities with the launch of our AccuBlue® platform. The AccuBlue® testing device screens for nine distinct water quality criteria. Our in-store experts leverage our proprietary AccuBlue® water diagnostics software engine to offer our consumers a customized prescription and treatment plan using our comprehensive range of exclusive products, walking them through product use sequencing step-by-step. These detailed and sophisticated treatment algorithms are supported by our differentiated water treatment expertise built over decades. Historically, we have found that consumers who test their water with us regularly spend more with us per year than those who do not, underscoring the importance of this acquisition and retention vehicle. We also employ the industry’s largest network

7

of in-field technicians who perform on-site evaluations, installation, and repair services for residential and commercial consumers.

Attractive financial profile characterized by consistent, profitable growth, and strong cash flow conversion offering multiple levers to drive shareholder value.

We have delivered 57 consecutive years of sales growth, demonstrating our ability to deliver strong financial results through all economic cycles. Our growth has been broad based across residential pool, residential spa, professional pool, and commercial pool consumers and has been driven by strong retention and profitable acquisition of sticky, long-term consumer relationships. Due to our scale, vertical integration, and operational excellence, we maintain high profitability. Due to our low maintenance capital intensity, we generate strong cash flows. As a result of our attractive financial profile, we have significant flexibility with respect to capital allocation, giving us the ability to drive long-term shareholder value through various operating and financial strategies.

Highly experienced and visionary management team that combines deep industry expertise and advanced, direct-to-consumer capabilities.

Our strategic vision and culture are directed by our executive management team under the leadership of our Chief Executive Officer, Michael R. Egeck and our Executive Vice President and Chief Financial Officer, Steven M. Weddell. Our well-balanced executive management team is comprised of leaders with decades of experience in the pool and spa care industry as well as recently hired executives who bring new expertise and capabilities to Leslie’s from outside industries. Our management team is uniquely capable of executing upon our strategic vision and successfully continuing to create long-term shareholder value.

Our Growth Strategies

Grow our consumer file.

We believe we have significant opportunity to acquire new residential consumers and reactivate lapsed residential consumers, which we plan to do by executing on the following strategies:

| • | Acquire or reactivate consumers via optimized marketing strategy. We believe we have a sizeable opportunity to grow by serving the millions of pool and spa owners in our market who do not actively shop with us today. We plan to accelerate our acquisition of these potential new or reactivated consumers and, at the same time, reduce consumer acquisition cost by shifting our marketing mix toward more efficient digital and social channels. |

| • | Capture outsized share of new pool and spa consumers. We have observed considerable recent acceleration in new pool and hot tub installations, bringing new consumers to our market. We intend to bolster consumer file growth by deploying targeted marketing tactics to win outsized share of this new consumer cohort. |

Increase share of wallet among existing consumers.

We currently serve a file of approximately 5.5 million active consumers, which represents approximately one-third of the estimated total addressable market of pool and spa owners. We define “active consumers” as consumers who transacted with us during the 18-month period ended October 3, 2020 and “lapsed residential consumers” as those who have shopped with us in the past, but have not transacted with us in the last 18 months. We believe we have a significant opportunity to

8

increase spend from existing consumers and drive higher lifetime value. We plan to do this by executing on the following strategies:

| • | Increase loyalty membership penetration and introduce program upgrades. We plan to continue to market our loyalty program in-store and online to convert more of our consumers to loyalty members. In May 2021, we launched our updated loyalty program, Pool Perks, in order to offer more value-added features to further drive member enrollment and engagement. We will explore opportunities to drive interest by selectively offering special incentives and rewards as well as introducing new value-added features. We believe these initiatives will drive higher transaction frequency and basket size, which will result in increased category spend and higher lifetime value with existing consumers. |

| • | Enhance retention marketing. While we have historically been satisfied with our consumer retention metrics, we believe there is opportunity to drive even greater retention. We plan to do this by more actively leveraging our consumer database to personalize the consumer experience with targeted messaging and product recommendations. |

| • | Expand our product and service offering. We plan to expand our offering by introducing new and innovative products and services in our existing categories and by expanding into adjacent categories. Specifically, we believe there is an opportunity with products targeted to spa owners, who have historically been underserved. |

Grow additional share in the professional market.

We believe we have a significant opportunity to grow our sales with pool care professionals, who individually spend more than 25x as much as residential consumers on pool supplies and equipment.

Our research suggests that small and mid-size pool professionals value convenience and referrals, both of which we are uniquely positioned to offer given our 900+ locations and industry’s largest consumer file. We plan to expand our physical network of PRO locations, which specifically cater to pool professionals, by opening new locations and selectively remodeling existing residential locations. We believe there is significant whitespace opportunity to operate more than 200 total PRO locations across the United States. We also plan to assemble an affiliated network of qualified pool professionals to extend the Leslie’s name into water maintenance. To further benefit pool care professionals, we launched our Leslie’s PRO e-commerce website in June 2021. This website provides all of the online tools needed for professionals to serve their respective communities and grow their pool care businesses. We believe that this initiative represents a natural adjacency and will resonate with existing residential consumers as well as help attract new residential consumers.

Utilize strategic M&A to consolidate share and further enhance capabilities.

The aftermarket pool and spa industry remains highly fragmented, which offers attractive opportunities to utilize strategic M&A to drive consolidation. We have historically used, and plan to continue to use, strategic acquisitions to obtain consumers and capabilities in both new and existing markets. We have completed two bolt-on acquisitions during fiscal 2021 to date and continue to look for opportunities that will strategically benefit our business. We believe that we are the consolidator of choice in the industry, and we will continue to focus on acquiring high quality, market-leading businesses with teams, capabilities, and technologies that uniquely position us to create value by applying best practices across our entire physical and digital network to better serve new and existing consumer types.

9

Addressing underserved residential whitespace.

We have identified more than 700 underserved residential pool and spa care markets in the continental United States. With our omni-channel capabilities, successful track record of new location openings, and targeted digital marketing tactics, we believe we are well positioned to capitalize on this meaningful whitespace opportunity. We plan to assess each market independently and determine the most capital efficient way to serve these trade areas using a mix of digital assets and physical locations.

Continue to introduce disruptive innovation.

Leslie’s has a legacy of disruptive innovation in the pool and spa care industry. We plan to continue that legacy by continuously developing and introducing capabilities that create value for our consumers. Present areas of focus include water testing, maintenance prescriptions, new product offerings, and our product distribution ecosystem.

As the Internet of Things wave continues, we believe consumers will seek the convenience of “smart” home functionality in more facets of their daily lives. We believe this presents an opportunity to introduce a full service, connected home solution that effectively automates pool maintenance, including actively monitoring our customer’s water, diagnosing, developing, and prescribing a treatment plan, and delivering to our customer’s home the assortment of products needed to maintain a clear, safe, beautiful pool.

Our Consumers

We strategically serve all consumers within the aftermarket pool and spa care industry including Residential Pool, Residential Spa, Professional Pool, and Commercial Pool consumers.

| • | Residential Pool. The residential pool market consists of 8.6 million pools representing a total aftermarket sales opportunity of $6.9 billion. Within this market, DIY aftermarket spend represents roughly 70% of total spend while DIFM services represent approximately 30% of total spend. Many of our residential pool consumers visit our locations on a regular basis to conduct water testing, seek expert pool advice, and purchase products as well as utilize our integrated digital platforms. |

| • | Residential Spa. The residential spa market consists of nearly 5.5 million spas or hot tubs representing a $0.7 billion aftermarket sales opportunity for chemicals and equipment. Including the $1.1 billion market for new spas, residential spa represents a total addressable market of approximately $1.8 billion. |

| • | Professional Pool. The professional pool market consists of nearly 45,000 professionals who spend an estimated $23,000 on chemicals and equipment per year on average, representing a total sales opportunity of more than $650 million. Our professional pool consumers specialize in pool maintenance and equipment repair for DIFM homeowners, businesses, and government entities. We provide pool professionals access to wholesale pricing across our integrated network. |

| • | Commercial Pool. The commercial pool market consists of more than 250,000 pools representing a total aftermarket sales opportunity of $2 billion. Our commercial pool consumers include operators of hotels, motels, apartment complexes, and water parks. |

10

Summary of Risk Factors

Our business is subject to numerous risks described in the section titled “Risk Factors” included elsewhere in this prospectus and in the section titled “Risk Factors” included in our Annual Report on Form 10-K for the year ended October 3, 2020, our Quarterly Report on Form 10-Q for the quarter ended January 2, 2021 and our Quarterly Report on Form 10-Q for the quarter ended April 3, 2021, which are incorporated by reference herein. You should carefully consider these risks before making an investment. Some of these risks include:

Risks Related to the Nature of Our Business

| • | If we are unable to achieve comparable sales growth, our profitability and performance could be materially adversely impacted. |

| • | Past growth may not be indicative of future growth. |

| • | Loss of key members of management could adversely affect our business. |

| • | We are subject to legal or other proceedings that could have a material adverse effect on us. |

| • | Disruptions from disasters and similar events could have a material adverse effect on our business. |

Risks Related to Our Industry and the Broader Economy

| • | We face competition by manufacturers, retailers, distributors, and service providers in the residential, professional, and commercial pool and spa care market. |

| • | The demand for our swimming pool and spa related products and services may be adversely affected by unfavorable economic conditions. |

| • | The outbreak of COVID-19 could adversely impact our business and results of operations. |

| • | The demand for pool chemicals may be affected by consumer attitudes towards products for environmental or safety reasons. |

| • | Our results of operations may fluctuate from quarter to quarter for many reasons, including seasonality. |

| • | We are susceptible to adverse weather conditions. |

Technology and Privacy Related Risks

| • | If our online systems do not function effectively, our operating results could be adversely affected. |

| • | Any limitation or restriction to sell on online platforms could harm our profitability. |

| • | A significant disturbance or breach of our technological infrastructure could adversely affect our financial condition and results of operations. |

| • | Improper activities by third parties and other events or developments may result in future intrusions into or compromise of our networks, payment card terminals or other payment systems. |

Risks Related to Our Business Strategy

| • | We may acquire other companies or technologies, which could fail to result in a commercial product and otherwise disrupt our business. |

11

| • | Our operating results will be harmed if we are unable to effectively manage and sustain our future growth or scale our operations. |

Risks Related to the Manufacturing, Processing, and Supply of Our Products

| • | Our business includes the packaging and storage of chemicals and an accident related to these chemicals could subject us to liability and increased costs. |

| • | Product supply disruptions may have an adverse effect on our profitability and operating results. |

| • | The cost of raw materials could increase our cost of goods sold and cause our results of operations and financial condition to suffer. |

Risks Related to Commercialization of Our Products

| • | The commercial success of our planned or future products is not guaranteed. |

| • | We may implement a product recall or voluntary market withdrawal, which could significantly increase our costs, damage our reputation, and disrupt our business. |

| • | If we do not manage product inventory effectively and efficiently, it could adversely affect profitability. |

| • | If we do not continue to obtain favorable purchase terms with manufacturers, it could adversely affect our operating results. |

Risks Related to Government Regulation

| • | The nature of our business subjects us to compliance with employment, environmental, health, transportation, safety, and other governmental regulations. |

| • | Product quality, warranty claims or safety concerns could impact our sales and expose us to litigation. |

Risks Related to Intellectual Property Matters

| • | If we are unable to adequately protect our intellectual property rights, our competitive position could be harmed or we could be required to incur significant expenses to enforce or defend our rights. |

| • | If we infringe on or misappropriate the proprietary rights of others, we may be liable for damages. |

Risks Related to Our Indebtedness

| • | Our substantial indebtedness could materially adversely affect our financial condition and our ability to operate our business. |

| • | Our ability to generate sufficient cash depends on numerous factors beyond our control, and we may be unable to generate sufficient cash flow to service our debt obligations. |

| • | Restrictive covenants in the agreements governing our Credit Facilities may restrict our ability to pursue our business strategies, and failure to comply with these restrictions could result in acceleration of our debt. |

| • | Incurrence of substantially more debt could further exacerbate the risks associated with our substantial leverage. |

12

| • | The phaseout of the London Interbank Offered Rate (LIBOR), or the replacement of LIBOR with a different reference rate, may adversely affect interest rate. |

Risks Related to Ownership of Our Common Stock

| • | Our stock price may be volatile, resulting in substantial losses for investors. |

| • | Future sales of shares by existing stockholders could cause our stock price to decline. |

| • | Stockholders’ ability to influence corporate matters may be limited because a small number of stockholders beneficially own a substantial amount of our common stock and continue to have substantial control over us. |

| • | Transactions engaged in by our principal stockholders, our officers or directors involving our common stock may have an adverse effect on the price of our stock. |

| • | We do not intend to pay dividends for the foreseeable future. |

| • | Anti-takeover provisions in our charter and under Delaware law could limit certain stockholder actions. |

| • | Certain provisions of our fifth amended and restated certificate of incorporation may have the effect of discouraging lawsuits against our directors and officers. |

| • | We will continue to incur increased costs as a result of being a public company. |

| • | If we are unable to effectively implement or maintain a system of internal control over financial reporting, we may not be able to accurately or timely report our financial results. |

| • | We were previously a “controlled company” within the meaning of the corporate governance standards of Nasdaq, and, as a result, you may not have the same protections afforded to stockholders of other companies during the transition period afforded to us by the rules of Nasdaq. |

Our Corporate Information

We were incorporated as a Delaware corporation on February 6, 2007.

Our principal executive offices are located at 2005 East Indian School Road, Phoenix, Arizona 85016 and our telephone number is (602) 366-3999. We maintain a website at the address www.lesliespool.com. Information contained on, or accessible through, our website is not a part of this prospectus or the registration statement of which this prospectus forms a part, and you should not rely on that information when making a decision to invest in our common stock.

13

| Issuer |

Leslie’s, Inc. | |

| Common stock offered by the selling stockholders |

24,500,000 shares (or 28,175,000 shares if the underwriters exercise in full their option to purchase additional shares). | |

| Option to purchase additional shares |

The selling stockholders have granted the underwriters a 30-day option to purchase up to 3,675,000 additional shares of our common stock from the selling stockholders at the public offering price. | |

| Common stock to be outstanding immediately after the offering |

189,284,566 shares. | |

| Use of proceeds |

The selling stockholders will receive all net proceeds from the sale of the shares of common stock to be sold in this offering, and we will not receive any of these proceeds. See the sections titled “Use of Proceeds,” “Principal and Selling Stockholders” and “Underwriting.” | |

| Nasdaq Trading Symbol |

“LESL” | |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| • | no vesting of the restricted stock units described below; and |

| • | no exercise by the underwriters of their option to purchase additional shares of common stock. |

The number of shares of our common stock to be outstanding after this offering is based on 189,284,566 shares of common stock outstanding as of June 4, 2021, and excludes:

| • | 6,935,475 shares of common stock reserved for future issuance under our 2020 Omnibus Incentive Plan; |

| • | 3,880,489 shares of common stock issuable upon the settlement of restricted stock units outstanding as of June 4, 2021; and |

| • | 5,049,470 shares of common stock issuable upon the exercise of stock options outstanding as of June 4, 2021 under our 2020 Omnibus Incentive Plan, at a weighted average exercise price of $18.04 per share. |

14

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER INFORMATION

The following table sets forth our summary consolidated statements of operations data for the six months ended April 3, 2021 and March 28, 2020 and the years ended October 3, 2020, September 28, 2019, and September 29, 2018, and our consolidated balance sheet data as of April 3, 2021, March 28, 2020, October 3, 2020, September 28, 2019, and September 29, 2018. We have derived the following consolidated statements of operations data for the years ended October 3, 2020, September 28, 2019, and September 29, 2018, and the balance sheet data as of October 3, 2020, September 28, 2019, and September 29, 2018 from our audited consolidated financial statements incorporated by reference in this prospectus. We have derived the following statements of operations data for the six months ended April 3, 2021 and March 28, 2020 and balance sheet data as of April 3, 2021 and March 28, 2020 from our unaudited interim consolidated financial statements. The unaudited interim consolidated financial data, in management’s opinion, have been prepared on the same basis as the audited consolidated financial statements and the related notes incorporated by reference in this prospectus, and include all adjustments, consisting only of normal recurring adjustments, that management considers necessary for a fair presentation of the information for the periods presented. Our historical results are not necessarily indicative of the results that may be expected for any future period. The following summary consolidated financial data should be read with the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included in our Annual Report on Form 10-K for the year ended October 3, 2020, and our Quarterly Report on Form 10-Q for the quarter ended April 3, 2021, which are incorporated by reference herein.

| (dollars in thousands, except per share amounts) | ||||||||||||||||||||

| Six Months Ended (unaudited) | Fiscal Year Ended (audited) | |||||||||||||||||||

| April 3, 2021 |

March 28, 2020 |

October 3, 2020(1) |

September 28, 2019 |

September 29, 2018 |

||||||||||||||||

| Statement of operations data: |

||||||||||||||||||||

| Sales |

$ | 337,447 | $ | 249,355 | $ | 1,112,229 | $ | 928,203 | $ | 892,600 | ||||||||||

| Cost of merchandise and services sold |

214,049 | 168,364 | 651,516 | 548,463 | 535,464 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

123,398 | 80,991 | 460,713 | 379,740 | 357,136 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Selling, general and administrative expenses |

147,863 | 115,769 | 314,338 | 258,152 | 241,669 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

(24,465 | ) | (34,778 | ) | 146,375 | 121,588 | 115,467 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other expense: |

||||||||||||||||||||

| Interest expense |

19,642 | 45,126 | 84,098 | 98,578 | 91,656 | |||||||||||||||

| Loss on debt extinguishment |

9,169 | — | — | — | — | |||||||||||||||

| Other expenses, net |

1,057 | 324 | 1,089 | 7,453 | 1,759 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other expense |

29,868 | 45,450 | 85,187 | 106,031 | 93,415 | |||||||||||||||

| Income (loss) before taxes |

(54,333 | ) | (80,228 | ) | 61,188 | 15,557 | 22,052 | |||||||||||||

| Income tax (benefit) expense |

(17,624 | ) | (24,215 | ) | 2,627 | 14,855 | 4,926 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (36,709 | ) | $ | (56,013 | ) | $ | 58,561 | $ | 702 | $ | 17,126 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

15

| (dollars in thousands, except per share amounts) | ||||||||||||||||||||

| Six Months Ended (unaudited) | Fiscal Year Ended (audited) | |||||||||||||||||||

| April 3, 2021 |

March 28, 2020 |

October 3, 2020(1) |

September 28, 2019 |

September 29, 2018 |

||||||||||||||||

| Balance sheet data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 90,328 | $ | 11,934 | $ | 157,072 | $ | 90,899 | $ | 77,569 | ||||||||||

| Total current assets |

468,252 | 329,129 | 372,133 | 282,089 | 255,332 | |||||||||||||||

| Total assets |

858,911 | 725,527 | 746,438 | 479,721 | 453,160 | |||||||||||||||

| Total current liabilities |

327,357 | 278,350 | 258,196 | 165,522 | 137,165 | |||||||||||||||

| Total liabilities |

1,249,921 | 1,667,690 | 1,573,437 | 1,367,078 | 1,342,109 | |||||||||||||||

| Total stockholders’ deficit |

(391,010 | ) | (942,163 | ) | (826,999 | ) | (887,357 | ) | (888,949 | ) | ||||||||||

| Cash flow data: |

||||||||||||||||||||

| Net cash provided by (used in) operating activities |

$ | (111,465 | ) | $ | (106,135 | ) | $ | 103,409 | $ | 57,821 | $ | 43,280 | ||||||||

| Net cash used in investing activities |

(13,126 | ) | (18,660 | ) | (26,811 | ) | (36,996 | ) | (40,219 | ) | ||||||||||

| Net cash provided by (used in) financing activities |

57,847 | 45,830 | (10,425 | ) | (7,495 | ) | (24,386 | ) | ||||||||||||

| Other financial and operations data: |

||||||||||||||||||||

| Number of new and acquired locations |

4 | 6 | 10 | 28 | 38 | |||||||||||||||

| Number of locations open at end of period |

940 | 932 | 936 | 952 | 940 | |||||||||||||||

| Comparable sales growth(2) |

33.7 | % | 8.4 | % | 18.0 | % | 0.4 | % | (1.3 | )% | ||||||||||

| Adjusted EBITDA(3) |

$ | 9,285 | $ | (17,085 | ) | $ | 182,770 | $ | 160,003 | $ | 151,799 | |||||||||

| Adjusted EBITDA as a percentage of sales(3) |

2.8 | % | (6.9 | )% | 16.4 | % | 17.2 | % | 17.0 | % | ||||||||||

| Adjusted net income (loss)(3) |

$ | (13,400 | ) | $ | (53,070 | ) | $ | 64,973 | $ | 12,765 | $ | 22,927 | ||||||||

| Adjusted net income (loss) per share |

$ | (0.07 | ) | $ | (0.34 | ) | $ | 0.42 | $ | 0.08 | $ | 0.15 | ||||||||

| (1) | Consisted of 53 weeks. Please see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for an explanation of our fiscal calendar. |

| (2) | Please see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Factors and Measures We Use to Evaluate Our Business” in our Annual Report on Form 10-K for the year ended October 3, 2020, and our Quarterly Report on Form 10-Q for the quarter ended April 3, 2021, which are incorporated by reference herein |

| (3) | Please see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended October 3, 2020, and our Quarterly Report on Form 10-Q for the quarter ended April 3, 2021, which are incorporated by reference herein for a reconciliation from our net income to adjusted EBITDA and net income to adjusted net income. |

16

Investing in our common stock involves a high degree of risk. You should consider and read carefully all of the risks and uncertainties described below as well as other information included in this prospectus and in the information incorporated by reference herein, including our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended October 3, 2020, our Quarterly Report on Form 10-Q for the quarter ended January 2, 2021 and our Quarterly Report on Form 10-Q for the quarter ended April 3, 2021, which are incorporated by reference herein, before making an investment decision. The risks described below are not the only ones facing us. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us or that we currently believe to be immaterial could materially and adversely affect our business, financial condition or results of operations. In such case, the trading price of our common stock could decline, and you may lose all or part of your original investment. This prospectus and the information incorporated by reference herein also contain forward-looking statements and estimates that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the risks and uncertainties described below.

Additionally, the COVID-19 pandemic may amplify many of the risks discussed below to which we are subject and, given the unpredictable, unprecedented and fluid nature of the pandemic, it may materially and adversely affect us in ways that are not anticipated by or known to us or that we do not consider to present significant risk. Therefore, we are unable to estimate the extent to which the pandemic and its related impacts will adversely affect our business, financial condition and results of operations as well as our stock price following completion of this offering.

Risks Related to the Offering

An active trading market for our common stock may not be sustained.

Although our common stock is traded on Nasdaq under the symbol “LESL,” there is a very limited trading history and an active trading market for our common stock may not be sustained. Accordingly, no assurance can be given as to the following:

| • | the likelihood that an active trading market for our common stock will be sustained; |

| • | the liquidity of any such market; |

| • | the ability of our stockholders to sell their shares of common stock; or |

| • | the price that our stockholders may obtain for their common stock. |

If an active market for our common stock with meaningful trading volume is not maintained, the market price of our common stock may decline materially below the offering price and you may not be able to sell your shares. The public offering price for our shares in this offering will be determined by negotiations between the selling stockholders and representatives of the underwriters and may not be indicative of prices that will prevail in the open market following this offering. Consequently, you may not be able to sell our common stock at prices equal to or greater than the price you paid in this offering.

17

The market price and trading volume of our stock may be volatile or may decline regardless of our operating performance, resulting in substantial losses for investors, and could decline substantially following this offering.

The market price and trading volume of our common stock may fluctuate significantly in response to numerous factors, many of which are beyond our control, including:

| • | actual or anticipated fluctuations in our results of operations; |

| • | the financial projections we may provide to the public, any changes in these projections, or our failure to meet these projections; |

| • | failure of securities analysts to initiate or maintain coverage of us, changes in financial estimates or ratings or negative reports by any securities analysts who follow us or our failure to meet these estimates or the expectations of investors; |

| • | announcements by us or our competitors of significant technical innovations, acquisitions, strategic partnerships, joint ventures, results of operations, or capital commitments; |

| • | changes in operating performance and stock market valuations of other retail companies generally, or those in our industry in particular; |

| • | price and volume fluctuations in the overall stock market, including as a result of trends in the economy as a whole; |

| • | changes in our board of directors or management; |

| • | sales of large blocks of our common stock, including sales by our executive officers or directors; |

| • | lawsuits threatened or filed against us; |

| • | changes in laws or regulations applicable to our business; |

| • | changes in our capital structure, such as future issuances of debt or equity securities; |

| • | short sales, hedging, and other derivative transactions involving our capital stock; |

| • | general economic conditions in the United States; |

| • | other events or factors, including those resulting from war, incidents of terrorism, pandemics, or other public health emergencies or responses to these events; and |

| • | the other factors described in the sections titled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” included in this prospectus and in the information incorporated by reference herein. |

Future sales of shares by existing stockholders could cause our stock price to decline.

If our existing stockholders sell, or indicate an intention to sell, substantial amounts of our common stock in the public market after the contractual lock-up agreements described below expire and other restrictions on resale lapse, the trading price of our common stock could be adversely impacted. As of June 4, 2021, we had 189,284,566 shares of common stock outstanding. In connection with this offering, our directors, executive officers and the selling stockholders have entered into lock-up agreements with the underwriters prohibiting sales of our common stock, subject to certain exceptions, for a period of 60 days following the date of this prospectus. In addition, as discussed in “Certain Relationships and Related Party Transactions,” in our Annual Report on Form 10-K for the year ended October 3, 2020, pursuant to our registration rights and lock-up agreement, certain of our stockholders are subject to additional lock-up periods, including the following:

| • | each stockholder party to our registration rights and lock-up agreement will be prohibited from selling shares for 90 days following any public offering subject to such agreement, subject to limited waivers and exceptions; and |

18

| • | any employee, member of management or director as of the time of closing of our initial public offering will be prohibited from selling shares for an additional 540 days, subject to limited waivers and exceptions, with such additional lock-up period expiring on October 18, 2022. |

The underwriters may permit our executive officers, directors and the selling stockholders who are subject to the contractual lock-up in connection with this offering to sell shares prior to the expiration of the lock-up agreements. Upon expiration of each of these lock-up periods, all such shares will be eligible for resale in the public market, subject to applicable securities laws, including the Securities Act. The trading price of our common stock could be adversely impacted if any of these certain significant stockholders sell, or indicate an intention to sell, substantial amounts of our common stock in the public market.

Stockholders’ ability to influence corporate matters may be limited because a small number of stockholders beneficially own a substantial amount of our common stock and continue to have substantial control over us.

As of June 4, 2021, our officers, directors and principal stockholders (greater than 5% stockholders) collectively beneficially own approximately 52% of our issued and outstanding common stock (40% following completion of this offering or 38% if the underwriters exercise their option to purchase additional shares in full). As a result, these stockholders will be able to exert significant influence over all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, such as a merger or other sale of our Company or its assets, and may have interests that are different from our other stockholders’ and may vote in a way with which other stockholders disagree and which may be adverse to the interests of our other stockholders. In addition, this concentration of ownership may have the effect of preventing, discouraging, or deferring a change of control, which could depress the market price of our common stock.

Transactions engaged in by our principal stockholders, our officers or directors involving our common stock may have an adverse effect on the price of our stock.

As described above, our officers, directors and principal stockholders (greater than 5% stockholders) collectively control approximately 52% of our issued and outstanding common stock as of June 4, 2021 (40% following completion of this offering or 38% if the underwriters exercise their option to purchase additional shares in full). Sales of our shares by these stockholders, including in this offering, could have the effect of lowering our stock price. The perceived risk associated with the possible sale of a large number of shares by these stockholders, or the adoption of significant short positions by hedge funds or other significant investors, could cause some of our stockholders to sell their stock, thus causing the price of our stock to decline. In addition, actual or anticipated downward pressure on our stock price due to actual or anticipated sales of stock by our directors or officers could cause other institutions or individuals to engage in short sales of our common stock, which may further cause the price of our stock to decline.

From time to time, our directors and executive officers may sell shares of our common stock on the open market. These sales will be publicly disclosed in filings made with the Securities and Exchange Commission (the “SEC”). In the future, our directors and executive officers may sell a significant number of shares for a variety of reasons unrelated to the performance of our business. Our stockholders may perceive these sales as a reflection on management’s view of the business and result in some stockholders selling their shares of our common stock. These sales could cause the price of our stock to drop.

19

Certain of our stockholders have the right to engage or invest in the same or similar businesses as us.

L Catterton and GIC Pte. Ltd. (“GIC”) each engage in other investments and business activities in addition to their ownership of us. Under our fifth amended and restated certificate of incorporation, L Catterton and GIC each have the right, and have no duty to abstain from exercising such right, to engage or invest in the same or similar businesses as us, do business with any of our customers or vendors, or employ or otherwise engage any of our officers, directors or employees. If L Catterton, GIC or any of their respective officers, directors or employees acquire knowledge of a potential transaction that could be a corporate opportunity, they have no duty, to the fullest extent permitted by law, to offer such corporate opportunity to us, our stockholders or our affiliates.

In the event that any of our directors and officers who is also a director, officer or employee of L Catterton or GIC acquires knowledge of a corporate opportunity or is offered a corporate opportunity, provided that this knowledge was not acquired solely in such person’s capacity as our director or officer and such person acts in good faith to the fullest extent permitted by law, then even if L Catterton or GIC pursue or acquire the corporate opportunity or if L Catterton or GIC do not present the corporate opportunity to us, such person is deemed to have fully satisfied such person’s fiduciary duties owed to us and is not liable to us.

20

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this prospectus, including statements regarding our future results of operations or financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. Our actual results could differ materially from those indicated in these forward-looking statements for a variety of reasons, including, among others:

| • | our ability to execute on our growth strategies; |

| • | our ability to maintain favorable relationships with suppliers and manufacturers; |

| • | competition from mass merchants and specialty retailers; |

| • | impacts on our business from the sensitivity of our business to weather conditions, changes in the economy, and the housing market; |

| • | our ability to implement technology initiatives that deliver the anticipated benefits, without disrupting our operations; |

| • | regulatory changes and development affecting our current and future products; |

| • | our ability to obtain additional capital to finance operations; |

| • | commodity price inflation and deflation; |

| • | impacts on our business from the COVID-19 pandemic; and |

| • | other risks and uncertainties, including those listed in the section titled “Risk Factors.” |

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this prospectus primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties, and other factors described in the section titled “Risk Factors” in this prospectus and the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended October 3, 2020, our Quarterly Report on Form 10-Q for the quarter ended January 2, 2021 and our Quarterly Report on Form 10-Q for the quarter ended April 3, 2021, which are incorporated by reference herein. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this prospectus. The results, events, and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.