Filed by the Registrant ☒ | ||

Filed by a Party other than the Registrant ☐ | ||

Check the appropriate box: | ||

☐ |

Preliminary Proxy Statement | |

☐ |

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material Pursuant to Section 240.14a-12 | |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): | ||||

☒ |

No fee required | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

2024

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS AND

PROXY STATEMENT

LETTER FROM THE CHIEF EXECUTIVE OFFICER

Dear Fellow Shareholders,

On behalf of the Board of Directors, it is our pleasure to invite you to attend the 2024 Annual Meeting of Shareholders of Leslie’s, Inc. The meeting will be held in a virtual format on Friday, March 15, 2024, beginning at 12:00 p.m. (Eastern Time). The meeting will be conducted via a live audiocast at www.virtualshareholdermeeting.com/LESL2024.

The following pages contain the formal Notice of Annual Meeting of Shareholders and Proxy Statement, which describe the specific business to be considered and voted upon at the Annual Meeting. The meeting will include a report on Leslie’s activities for the fiscal year ended September 30, 2023, and there will be an opportunity for comments and questions from shareholders.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. After reviewing the Proxy Statement, we ask you to vote as described in the Proxy Statement as soon as possible.

On behalf of our Board of Directors, we would like to thank you for your continued interest and investment in Leslie’s.

| Yours Sincerely,

|

||||||

|

|

Michael R. Egeck Chief Executive Officer 2005 East Indian School Road Phoenix, Arizona 85016 January 24, 2024 |

| Proxy Statement and Annual Meeting Report 2024 |

Notice of Annual Meeting of Shareholders

|

|

DATE AND TIME Friday, March 15, 2023 12:00 p.m. Eastern Time

|

|

WHO CAN VOTE Shareholders of record as of 5:00 p.m. Eastern Time on January 17, 2024 will be entitled to notice of, and to vote at, the Annual Meeting, or any adjournment thereof. | |||||

|

|

LOCATION Online via live audiocast on

|

VOTING ITEMS

| Proposals | Board Vote Recommendation | For Further Details | ||||

| 1. | Election of three Class III directors, as named in this proxy statement | “FOR” each director nominee listed in Proposal 1 | Page 16 | |||

| 2. | Ratification of appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024 | “FOR” | Page 22 | |||

| 3. | Non-binding, advisory vote to approve named executive officer compensation | “FOR” | Page 24 | |||

| 4. | Approval of the Leslie’s, Inc. Amended and Restated 2020 Omnibus Incentive Plan | “FOR” | Page 46 | |||

Shareholders will also transact any other business that may be properly presented at the Annual Meeting. This proxy statement is first being made available to our shareholders on or about January 24, 2024.

The purpose of the Annual Meeting is to consider and take action on the proposals stated above and discussed more thoroughly in the proxy materials. We are holding the Annual Meeting in a virtual-only format this year. To attend the Annual Meeting online, vote or submit questions during the meeting, shareholders of record will need to go to the meeting website listed above and log in using their 16-digit control number included on their proxy card. Beneficial owners should review these proxy materials and their voting instruction form for how to vote in advance of and how to participate in the Annual Meeting or, otherwise, contact their bank, broker or other nominee (preferably at least 5 days before the Annual Meeting) and obtain a “legal proxy” in order to be able to attend, participate in or vote at the annual meeting.

In the event of a technical malfunction or other situation that the meeting chair determines may affect the ability of the Annual Meeting to satisfy the requirements for a meeting of shareholders to be held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the Annual Meeting, the chair or secretary of the Annual Meeting will convene the meeting at 12:30 p.m. Eastern Time on the date specified above and at the Company’s address specified below solely for the purpose of adjourning the meeting to reconvene at a date, time and physical or virtual location announced by the meeting chair. Under either of the foregoing circumstances, we will post information regarding the announcement on the Company’s Investor Relations page at https://ir.lesliespool.com/.

We encourage you to review these proxy materials and vote your shares before the Annual Meeting, your vote is important.

By Order of the Board of Directors,

Brad Gazaway

Chief Legal, Real Estate & Sustainability Officer and Corporate Secretary

2005 East Indian School Road

Phoenix, Arizona 85016

January 24, 2024

HOW TO VOTE

|

|

| ||

|

INTERNET www.proxyvote.com |

TELEPHONE 1-800-690-6903 |

Mark, sign, date and promptly mail

| ||

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MARCH 15, 2024

The notice, Proxy Statement, and 2023 Annual Report on Form 10-K are available at www.proxyvote.com. | ||||

| Proxy Statement and Annual Meeting Report 2024 |

TABLE OF CONTENTS

Table of Contents

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 14 | ||||

| 16 | ||||

| 17 | ||||

| Nominees for Election to a Three-Year Term Expiring at the 2027 Annual Meeting of Shareholders |

17 | |||

| Directors Continuing in Office Until the 2025 Annual Meeting of Shareholders |

19 | |||

| Directors Continuing in Office Until the 2026 Annual Meeting of Shareholders |

21 | |||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 32 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| Proxy Statement and Annual Meeting Report 2024 |

i |

TABLE OF CONTENTS

| PROPOSAL 4: APPROVAL OF THE LESLIE’S, INC. AMENDED AND RESTATED 2020 OMNIBUS INCENTIVE PLAN |

46 | |||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 48 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| 56 | ||||

| Policies and Procedures for the Company’s |

56 | |||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 59 | ||||

| 63 | ||||

| A-1 | ||||

| Leslie’s, Inc. Amended & Restated 2020 Omnibus Incentive Plan |

A-1 | |||

|

FORWARD-LOOKING STATEMENTS AND WEBSITE REFERENCES

This document includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current facts, including statements regarding our environmental and other sustainability plans and goals, made in this document are forward-looking. We use words such as “may,” “will,” “likely,” “anticipates,” “believes,” “expects,” “estimates,” “future,” “intends,” “continue,” “maintain,” “remain,” “goal,” “target,” “recurring,” and similar expressions to identify forward-looking statements. Forward-looking statements reflect management’s current expectations and involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our fiscal year 2023 Annual Report on Form 10-K. Our forward-looking statements speak only as of the date of this document or as of the date they are made, and we undertake no obligation to update them, notwithstanding any historical practice of doing so. Forward-looking and other statements in this document may also address our corporate responsibility and sustainability progress, plans, and goals (including environmental and diversity & inclusion matters), and the inclusion of such statements is not an indication that these contents are necessarily material to investors or required to be disclosed in the Company’s filings with the SEC. In addition, historical, current, and forward-looking environmental and social-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future. We caution you that these statements are not guarantees of future performance, nor promises that goals or targets will be met, and are subject to numerous and evolving risks and uncertainties that we may not be able to predict or assess. In some cases, we may determine to adjust our commitments, goals or targets or establish new ones to reflect changes in our business, operations or plans. Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

|

| ii Leslie’s, Inc. |

Proxy Statement Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

|

|

|

| ||

|

DATE AND TIME

March 15, 2024, at 12:00 p.m. |

LOCATION

Online at

|

RECORD DATE

January 17, 2024 | ||

| Voting Matters | Board’s Vote Recommendations | For Further Information | ||||

| PROPOSAL 1 | Election of three Class III directors, as named in this proxy statement | “FOR” each director nominee listed in Proposal 1 | Page 16 | |||

| PROPOSAL 2 | Ratification of appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024 | “FOR” | Page 22 | |||

| PROPOSAL 3 | Non-binding, advisory vote to approve named executive officer compensation | “FOR” | Page 24 | |||

| PROPOSAL 4 | Approval of the Leslie’s, Inc. Amended and Restated 2020 Omnibus Incentive Plan | “FOR” | Page 46 | |||

COMPANY OVERVIEW AND BUSINESS STRATEGY

We are the largest and most trusted direct-to-consumer brand in the $15 billion United States pool and spa care industry, serving residential and professional consumers. Founded in 1963, we are the only direct-to-consumer pool and spa care brand with national scale, operating an integrated marketing and distribution ecosystem powered by a physical network of over 1,000 branded locations and a robust digital platform. We have a market-leading share of approximately 15% of residential aftermarket product spend as of 2022, our physical network is larger than the sum of our 20 largest competitors and our digital sales are estimated to be greater than five times as large as that of our largest digital competitor. We offer an extensive assortment of professional-grade products, the majority of which are exclusive to Leslie’s, Inc. (“Company” or “Leslie’s”), as well as certified installation and repair services, all of which are essential to the ongoing maintenance of pools and spas. Our dedicated team of associates, pool and spa care experts, and experienced service technicians are passionate about empowering our consumers with the knowledge, products, and solutions necessary to confidently maintain and enjoy their pools and spas. The unprecedented scale of our integrated marketing and distribution ecosystem, which is powered by our direct-to-consumer network, uniquely enables us to efficiently reach and service every pool and spa in the continental United States.

We operate primarily in the pool and spa aftermarket industry, which is broadly comprised of: (i) chemicals; (ii) equipment, parts and accessories; and (iii) services, and is one of the most fundamentally attractive consumer categories given its scale, predictability, and growth outlook. More than 80% of our assortment is comprised of non-discretionary products essential to the care of residential and commercial pools and spas.

Consumers receive the benefit of extended vendor warranties on products purchased through our locations and on on-site installations or repairs by our certified in-field technicians. We offer complimentary, commercial-grade in-store water testing and analysis via our proprietary AccuBlue® system, which increases consumer engagement, conversion, basket size, and loyalty,

| Proxy Statement and Annual Meeting Report 2024 |

1 |

PROXY STATEMENT SUMMARY

resulting in higher lifetime value. Our water treatment expertise is powered by data and intelligence accumulated from the millions of water tests we have performed over the years, positioning us as the most trusted water treatment service provider in the industry. Due to the non-discretionary nature of our products and services, our business has historically delivered strong, uninterrupted growth and profitability in all market environments, including through the Great Recession and the COVID-19 pandemic.

We have a legacy of leadership and disruptive innovation. Since our founding in 1963, we have been the leading innovator in our category and have provided our consumers with the most advanced pool and spa care available. As we have scaled, we have leveraged our competitive advantages to strategically reinvest in our business and intellectual property to develop new value-added capabilities. We have pioneered complimentary in-store water testing, offered complimentary in-store equipment repair services, introduced the industry’s first loyalty program, and developed an expansive platform of owned and exclusive brands. These differentiated capabilities allow us to meet the needs of any pool and spa owner, whether they care for their pool or spa themselves or rely on a professional, whenever, wherever, and however they choose to engage with us.

| 2 Leslie’s, Inc. |

PROXY STATEMENT SUMMARY

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE

Leslie’s strives to make a positive difference for all of our stakeholders – our consumers, associates, shareholders, and the communities in which we operate. These efforts include integrating our ESG program throughout our culture, strategy, and business and monitoring our performance along the way. Our focus on delivering total solutions for pool and spa owners while working to support the interests of all of our stakeholders is the foundation upon which we believe continuously improved performance and strong financial results are built.

The actions and accomplishments presented in our annual ESG Reports demonstrate how Leslie’s prioritizes and manages key ESG risks and opportunities. We believe that by dedicating the necessary attention and resources to internal programs and processes, we can enhance Leslie’s operational and reporting performance in areas including, but not limited to, diversity, equity, and inclusion, environmental, health, and safety management, product and supply chain sustainability, community engagement and water safety, and human capital management. This focus has led to greater depth to Leslie’s monitoring programs, which in 2023 have expanded to include procurement spend reports on business enterprises and additional waste and Scope 3 category data within its environmental management program. The measurement and management of Leslie’s ESG priorities continues to propel Leslie’s forward as a leader in our industry.

ESG Governance

ESG oversight has been a top priority since Leslie’s went public in October 2020. From the outset, we have ensured that sustainability and ESG issues are governed across our business units and up through our management team to our Board of Directors (“Board”). The Nominating and Corporate Governance Committee of the Board responsibilities include reviewing and monitoring ESG, and sustainability matters and is reflected in the Governance Committee’s Charter. ESG is supported by the following oversight structure:

| • | Board: Governs and oversees our corporate strategy and decision making to ensure alignment with our mission, values, strategy, risk profile and ESG priorities. |

| • | Board Committees: Remain informed and advise the Board on specific ESG matters, such as cybersecurity, human capital management and board refreshment, among others. |

| • | ESG Sub-Committee of the Nominating and Corporate Governance Committee: Oversees the establishment, review, and observation of our ESG priorities and outreach. |

| • | Management Team: Monitors and implements our strategies, policies, programs, and procedures and reports to the Board and its committees. |

| • | Chief Legal, Real Estate, & Sustainability Officer: Serves as executive lead of our ESG initiatives with support from our Director of ESG. |

| • | Sustainability Working Group: Guides the operational execution, monitoring, and reporting of our ESG initiatives. |

More information on Leslie’s ESG efforts is available on our Investor Relations page at https://ir.lesliespool.com/esg.

Diversity & inclusion

Leslie’s is proud to have a culture of inclusion that motivates us to celebrate and embrace the different backgrounds and perspectives that drive our success. Our associates bring their own unique talents, qualities, and contributions to Leslie’s, with our executive leadership team, Diversity and Inclusion Advisory Council (Dive In), and associates from across the Company working together to welcome everyone and inspire each other, each and every day. We are working to foster and maintain an engaged and inclusive workplace that learns from one another through workshops, insight surveys, and our employee resource groups.

Leslie’s DEI program is advanced by the 60-member Dive In Council, which includes the Chief People Officer as its executive lead. Progress and initiatives are periodically reported to the CEO and the Board’s Compensation Committee. Among other things, Leslie’s requires annual unconscious bias training for all associates and held an inclusive leadership training with the executive team in fiscal year 2023. In 2020, Leslie’s announced its overarching goal to achieve a diverse workforce that mirrors the U.S. census population by 2025. As part of our commitment to transparency, we have disclosed our workforce diversity data by gender, race and ethnicity in our consolidated EEO-1 report in 2022. Leslie’s EEO-1 Report can be found on our Investor Relations page at https://ir.lesliespool.com/esg.

| Proxy Statement and Annual Meeting Report 2024 |

3 |

PROXY STATEMENT SUMMARY

Environmental, health, and safety management

Our highest operational priority is that Leslie’s products and locations offer safe experiences for our customers and associates. We seek to take a preventative and systematic approach to health and safety matters and to instill a culture of safety across the Company. We strive to emphasize and demonstrate our collective responsibility as members of the Leslie’s community.

We also recognize that our manufacturing and distribution centers, offices, and retail stores, and the logistical decisions we make, each uniquely contribute to our resource use. Over the years, we have endeavored to improve our operational efficiencies by considering ways to enhance our monitoring programs and implement practices that reduce our impact. Leslie’s environmental management approach calls for compliance with all applicable local, state, federal, and international laws, and regulations.

Measures we have undertaken to understand our environmental impact include expanding our environmental monitoring program to encompass waste and an enhanced list of Scope 3 greenhouse gas (“GHG”) emissions alongside our current water, energy, and Scope 1 and 2 GHG emissions reporting. We will aim to continue to align our ESG reporting with leading frameworks including the Sustainable Accounting Standards Board (“SASB”) standards and the United Nations Sustainable Development Goals (“UN SDGs”).

Sustainable products & supply chain

We are helping to create backyard moments that are safe for people and the planet through the products we offer, the awareness we raise, the partners we engage, and the procurement and packaging practices we apply. By monitoring and setting expectations within our supply chain, we aim to maintain and expand responsible practices throughout our day-to-day operations. In collaboration with our vendor partners, we strive to provide new innovative products that improve energy and water conservation and reduce chemical consumption.

Community engagement and water safety

Each and every day, we are inspired to serve others. We are dedicated to helping pool owners meet their needs and build backyard memories. We raise awareness and provide consumer training on proper water safety, and we support and partner with our local and national communities to make a difference in peoples’ lives. Guided by our Philanthropic Council and Charitable Foundation, we give back both in and out of the water.

Leslie’s philanthropic pursuits are guided by four core pillars and their respective pillar partners: (i) water safety and community: YMCA and Boys & Girls Club; (ii) diversity, equity, and inclusion: NAACP; (iii) health and wellness: St. Jude Children’s Research Hospital; and (iv) disaster relief: American Red Cross. Leslie’s Philanthropy Council oversees the philanthropic programs and Leslie’s Charitable Foundation. Between fiscal years 2021 and 2023, Leslie’s committed $1.5 million over three years to support the core pillars and pillar partners. Programs Leslie’s has supported include drowning education campaigns with the YMCA and Boys & Girls Club, walk and run events with St. Jude, and disaster relief support for communities impacted by the war in Ukraine and hurricanes in Florida. In 2023, Leslie’s launched a diverse small business grant program in partnership with the NAACP.

HUMAN CAPITAL MANAGEMENT

As of September 30, 2023, we employed approximately 4,100 employees. Of these employees, approximately 3,200 work in our physical network, approximately 250 work as in-field service technicians, approximately 360 work in our corporate office, and approximately 275 work in our distribution centers. We believe that we have good relations with our employees. None of our employees are currently covered under any collective bargaining agreements.

We consider our employees to be the foundation for our growth and success. As such, our future success depends in large part on our ability to attract, train, retain, and motivate qualified personnel. The growth and development of our workforce is an integral part of our success. We place a priority on promoting from within. Over the last three years, approximately 80% of our retail and corporate management openings have been filled by existing employees.

| 4 Leslie’s, Inc. |

PROXY STATEMENT SUMMARY

We are also focused on maintaining and fostering a culture of diversity and inclusion and know that a company’s ultimate success is directly linked to its ability to identify and hire talented individuals from all backgrounds and perspectives.

DIRECTOR NOMINEES

The following provides summary information about each director nominee up for election at the 2024 Annual Meeting.

| Name and Occupation |

Age | Other Public Boards |

Committee Memberships | |||||||

| AC | CC | NCGC | ||||||||

| Susan O’Farrell

Former CFO, BlueLinx Holdings, Inc. |

60 | 1 |

|

|||||||

| Claire Spofford

CEO and President, J.Jill |

62 | 1 |

|

| ||||||

| Seth Estep

EVP, Chief Merchandising Officer, Tractor Supply Company |

44 | 0 |

|

| ||||||

ALL OTHER DIRECTORS

The following provides summary information about all other directors not up for election at the 2024 Annual Meeting (“Annual Meeting”), as of January 1, 2024. In 2023 we commenced the declassification of our Board with the implementation of our Sixth Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”). In accordance with the Certificate of Incorporation, directors with terms expiring at our 2025 Annual Meeting will stand for re-election to a two-year term at the 2025 Annual Meeting, and directors with terms expiring at our 2026 Annual Meeting will stand for re-election to a one-year term at the 2026 Annual Meeting. Beginning with our 2027 Annual Meeting, all directors will be elected to a one-year term.

| Name and Occupation |

Age | Other Public Boards |

Committee Memberships | |||||||

| AC | CC | NCGC | ||||||||

| Michael R. Egeck CEO, Leslie’s, Inc. |

65 | 0 | ||||||||

| Yolanda Daniel

Former VP Finance, Federal Reserve Bank of Chicago |

57 | 0 |

|

| ||||||

| Eric Kufel Former CEO, West Marine, Inc. |

57 | 0 | ||||||||

| John Strain

Chairman-Elect, Former Head of e-Commerce and Technology, Gap, Inc. |

55 | 0 |

|

|

||||||

| Steven L. Ortega2 Former CEO, Current Chairman, Leslie’s, Inc. |

62 | 1 | ||||||||

| AC – Audit Committee CC – Compensation Committee NCGC – Nominating and Corporate Governance Committee

|

|

| (1) | Following the conclusion of the 2024 Annual Meeting, Seth Estep will become the chairman of the Compensation Committee. |

| (2) | Steven L. Ortega is not standing for re-election at the Annual Meeting and will be succeeded as Chairman by Chairman-Elect John Strain. |

| Proxy Statement and Annual Meeting Report 2024 |

5 |

PROXY STATEMENT SUMMARY

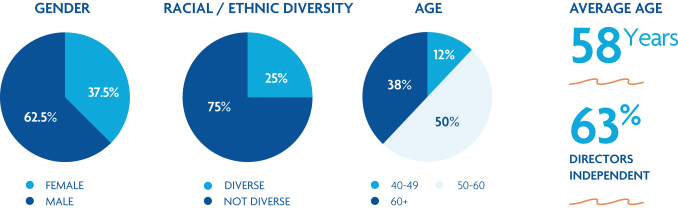

| BOARD SNAPSHOT | ||||

| (as of January 1, 2024) |

| SKILLS & EXPERIENCE |

||||

| (as of January 1, 2024) |

||||

| SKILLS AND EXPERIENCE |

Daniel | Egeck | Estep | Kufel | O’Farrell | Ortega | Spofford | Strain | ||||||||||

|

Retail/Merchandising | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||

|

Strategic Management | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||

|

Supply Chain | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||

|

Brand and Consumer Marketing | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||||

|

Digital Commerce and Marketing | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||

|

Human Capital Management | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||

|

Information Technology and Cyber Security |

🌑 | 🌑 | |||||||||||||||

|

Finance/Accounting | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||

|

Governance/Risk Management | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||

|

Senior Leadership | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||

|

ESG/DEI | 🌑 | 🌑 | |||||||||||||||

|

Public Company Experience | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||

| BACKGROUND |

||||||||||||||||||

|

Gender 🌑 Male O Female |

O | 🌑 | 🌑 | 🌑 | O | 🌑 | O | 🌑 | |||||||||

|

African American or Black | 🌑 | ||||||||||||||||

| Hispanic or Latinx | 🌑 | |||||||||||||||||

| White | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||

| 6 Leslie’s, Inc. |

PROXY STATEMENT SUMMARY

| Skills and Experience Categories | ||||

|

Retail/Merchandising | Important in understanding our industry, business needs and strategic goals | ||

|

Strategic Management | Important in implementing our goals and aligning on long-term business investments and objectives and our capital allocation | ||

|

Supply Chain | Important to oversee upstream and downstream structure and design of the supply chain, all of which are critical to our strategic goals | ||

|

Brand and Consumer Marketing | Important as marketing and communications are critical to building and expanding our market share | ||

|

Digital Commerce and Marketing | Important in overseeing the development of our multi-channel strategy | ||

|

Human Capital Management | Important to oversee our significant associate base that is growing, so that we place the best investments in our associates | ||

|

|

Information Technology and Cyber Security |

Important as we assess our technology and cybersecurity needs, along with the needs of our customers, among other reasons to protect our customers’ data | ||

|

Finance/Accounting | Important to oversee and understand our financial statements, capital structure and internal controls | ||

|

Governance/Risk Management | Supports our objective to have corporate governance and risk management practices that reflect industry best practices | ||

|

Senior Leadership | Important as leadership experience can provide insight on business operations, growth and culture | ||

|

ESG/DEI | Helpful in our work as a values driven organization | ||

|

Public Company Experience | Important to oversee the workings of a public company | ||

| Board Diversity Matrix (as of January 1, 2024) |

||||||||

| Total Number of Directors |

8 | |||||||

| Female | Male | |||||||

| Part I: Gender Identity |

||||||||

| Directors |

3 | 5 | ||||||

| Part II: Demographic Background |

||||||||

| African American or Black |

1 | 0 | ||||||

| Hispanic or Latinx |

0 | 1 | ||||||

| White |

2 | 4 | ||||||

CORPORATE GOVERNANCE HIGHLIGHTS

| • | The Board consists of a diverse mix of individuals with distinctive skills and experience |

| • | Separate Chairman and Chief Executive Officer |

| • | Lead Independent Director designated when Chairman is not independent |

| • | Commenced Board declassification in 2023 with classified Board to be phased out by 2027 |

| • | Majority of Board directors are independent directors |

| • | Only independent directors sit on Board committees |

| • | Average director age of 58 years |

| • | Annual Board and committee self-evaluations |

| • | Annual director evaluations |

| • | Executive sessions for Independent Directors |

| • | Directors and other designated officers are subject to stock ownership guidelines |

| • | Consistent outreach with our shareholders related to governance and other matters |

| • | Hedging/pledging prohibited |

| Proxy Statement and Annual Meeting Report 2024 |

7 |

Corporate Governance

DIRECTOR INDEPENDENCE

Our Board has undertaken a review of its composition, the composition of its committees and the independence of each director. Based upon information provided by each director, our Board has determined that no person who served as a director during any part of fiscal year 2023, with the exception of Messrs. Egeck, Kufel, Ortega, and Magliacano, has or had a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and is independent under applicable Nasdaq rules. In making these determinations, our Board considered the current and prior relationships that each non-employee director has with the Company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in the section titled “Certain Relationships and Related Party Transactions.”

BOARD LEADERSHIP STRUCTURE

The Board annually reviews its leadership structure to evaluate whether the structure remains appropriate for the Company. The Board selects its Chairman and the Chief Executive Officer (“CEO”) in a way it considers is in the best interests of the Company. The Board does not have a policy on whether the role of Chairman and CEO should be separate or combined. The Board has determined, however, that wherever and for so long as the Chairman is not an independent director, then there shall also be a lead independent director.

Prior to the expiration of his term at the Annual Meeting, our Chairman is Steven L. Ortega, and the Lead Independent Director is John Strain. Following the expiration of Mr. Ortega’s term, Mr. Strain, as Chairman-Elect, will succeed him as Chairman and vacate the position of Lead Independent Director, as the Board is not required to designate a Lead Independent Director when the chairperson is an independent director.

LEAD INDEPENDENT DIRECTOR

Whenever the chairperson is not an independent director, the Board will designate a lead independent director. The Lead Independent Director’s responsibilities include the following:

| • | presiding at all meetings of the Board at which the chairperson of the Board is not present, including executive sessions of non-employee directors and independent directors; |

| • | approving information sent to the Board and overseeing that the scope, quality, quantity and timeliness of the flow of information between management and the Board is adequate for the Board to effectively and responsibly perform its duties; |

| • | consulting with the chairperson of the Board regarding agendas for all meetings of the Board as well as contributing to and approving them; |

| • | approving Board meeting schedules to provide that there is sufficient time for discussion of all agenda items; |

| • | serving as a liaison between the chairperson of the Board and the independent directors; and |

| • | if requested by major shareholders, being available for consultation and direct communication. |

In addition, the Lead Independent Director also has the authority to call meetings of the independent directors.

DIRECTOR NOMINATIONS

In accordance with its charter, the Nominating and Corporate Governance Committee determines the qualifications, qualities, skills, and other expertise required to be a director and recommends to the Board criteria to be considered in selecting nominees for directors. These will inform the committee’s annual evaluation of the experience and characteristics appropriate for Board members and director candidates in light of the Board’s composition, and the skills and expertise needed for effective operation

| 8 Leslie’s, Inc. |

CORPORATE GOVERNANCE

of the Board and its committees. The Board and the Nominating and Corporate Governance Committee also ensures that qualified director candidates with a diversity of gender, ethnicity, tenure, skills and experience are included by the Company or any search firm it engages in each pool of candidates from which Board nominees are chosen.

The Nominating and Corporate Governance Committee reviews the qualifications of director candidates and incumbent directors in light of the criteria approved by Board, and any shareholder recommendations for director are evaluated in the same manner as other candidates considered by the Nominating and Corporate Governance Committee. Shareholders that wish to recommend a director candidate should follow the procedures set forth below under “Communications with Directors,” and shareholders that wish to nominate a director for election to our Board should follow the procedures described under the “Submission of Shareholder Proposals for the 2025 Annual Meeting” heading.

We generally evaluate the following criteria regarding director qualifications for our directors to possess: educational background, knowledge of our business, integrity, professional reputation, independence, wisdom, and ability to represent the best interests of our shareholders. In addition, the Board believes that diversity, including gender, race and ethnicity, brings a diversity of viewpoints to the Board that is important to the effectiveness of the Board’s oversight of the Company, and the Board and the Nominating and Corporate Governance Committee also evaluate candidates’ ability to contribute to the Board’s diversity, including with respect to gender, ethnic diversity, and diversity of professional experience, such as whether the person is a current or was a former chief executive officer or chief financial officer of a public company or the head of a division of a prominent international organization. The Board assesses its effectiveness in this regard as part of the annual Board and Board Committee annual self-assessment process described below.

The Nominating and Corporate Governance Committee of the Board prepares policies regarding director qualification requirements and the process for identifying and evaluating director candidates for adoption by the Board. The above-mentioned attributes, along with the leadership skills and other experiences of our officers and Board members described above, are expected to provide us with a diverse range of perspectives and judgment necessary to facilitate our goals of shareholder value appreciation through organic and acquisition growth.

BOARD AND BOARD COMMITTEES ANNUAL SELF-ASSESSMENTS

On an annual basis, the Board and the Board Committees conduct written self-assessments on their respective performance throughout the past year. These written self-assessments are completed by each Board director and Board Committee member, and then the results are compiled and reviewed by the Board and/or respective Board Committee.

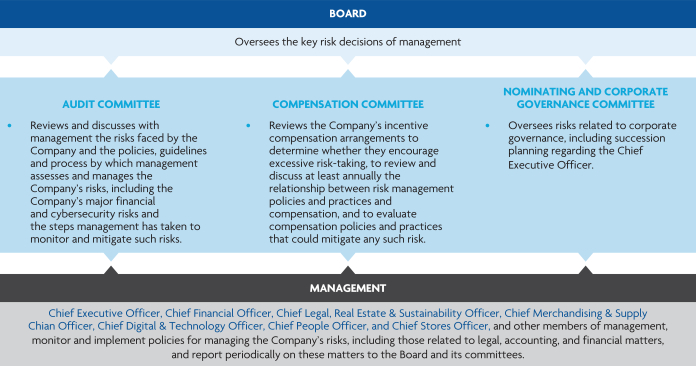

BOARD COMMITTEES

Our Board has three standing committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee.

In accordance with our Corporate Governance Guidelines, the independent directors meet in executive session without management present on a regularly scheduled basis.

During the fiscal year ended September 30, 2023, the Board held eight meetings, and there were nine meetings of the Audit Committee, four meetings of the Compensation Committee and four meetings of the Nominating and Corporate Governance Committee. All incumbent directors attended at least 75% of the aggregate of the meetings of the Board and committees on which they served occurring during fiscal year 2023.

Directors are expected to attend the annual meeting of shareholders absent unusual circumstances. Eight of the ten then-current members of the Board attended the prior year’s annual meeting, with Ms. Kozlak and Mr. Magliacano not attending.

| Proxy Statement and Annual Meeting Report 2024 |

9 |

CORPORATE GOVERNANCE

| AUDIT COMMITTEE | ||

|

MEMBERS Susan O’Farrell (Chair) Yolanda Daniel John Strain |

PRINCIPAL RESPONSIBILITIES:

The primary role of the Audit Committee is to oversee the Company’s accounting and financial reporting processes and the audits of the Company’s financial statements. Management of the Company is responsible for preparing the Company’s financial statements, determining that they are complete, accurate, and in accordance with generally accepted accounting principles in the United States (“US GAAP”) and establishing and maintaining satisfactory disclosure controls and internal control over financial reporting. The independent public accounting firm is responsible for auditing the Company’s financial statements and expressing an opinion on the conformity of those consolidated financial statements with US GAAP and expressing an opinion as to the effectiveness of the Company’s internal controls over financial reporting.

We have adopted a committee charter that details the principal functions of the Audit Committee, including:

• selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

• helping to oversee the independence and performance of the independent registered public accounting firm;

• reviewing financial statements and discussing the scope and results of the independent audit and quarterly reviews with the independent registered public accounting firm, and reviewing, with management and the independent registered public accounting firm, our interim and year-end results of operations;

• preparing the audit committee report that the Securities and Exchange Commission (“SEC”) requires to be included in our annual proxy statement;

• reviewing the adequacy and effectiveness of our internal control over financial reporting and disclosure controls and procedures, and overseeing procedures for employees to submit concerns anonymously about accounting, internal control, or audit matters;

• reviewing and approving the function of our internal audit department;

• reviewing our policies on risk assessment and risk management;

• reviewing related party transactions; and

• approving or, as required, pre-approving, all audit and all permissible non-audit services and fees, to be performed by the independent registered public accounting firm.

Under the Nasdaq listing rules and applicable SEC rules, we are required to have at least three members of the Audit Committee, all of whom must be independent. Each member of the Audit Committee is financially literate, and our Board has determined that Ms. O’Farrell and Ms. Daniel both qualify as an “audit committee financial expert” as defined in applicable SEC rules and have accounting or related financial management expertise.

The Audit Committee has established and oversees procedures for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal controls over financial reporting and the confidential, anonymous submission by Company employees of concerns regarding questionable accounting or auditing matters. The Audit Committee has the authority to retain counsel and other advisers as it determines necessary to fulfill its duties and responsibilities.

| |

| 10 Leslie’s, Inc. |

CORPORATE GOVERNANCE

| COMPENSATION COMMITTEE | ||

|

MEMBERS John Strain (Chair) Seth Estep Claire Spofford |

PRINCIPAL RESPONSIBILITIES:

The primary role of the Compensation Committee is to assist the Board with the oversight of executive compensation.

We have adopted a committee charter that details the principal functions of the Compensation Committee, including:

• reviewing, approving and determining, or making recommendations to our Board regarding the compensation of our executive officers;

• overseeing our overall compensation philosophy and compensation policies, plans and benefit programs for service providers, including our executive officers;

• administering our equity compensation plans; and

• reviewing, approving, and making recommendations to our Board regarding incentive compensation and equity compensation plans.

The Compensation Committee may delegate its duties and responsibilities to one or more subcommittees as it determines appropriate.

The Compensation Committee is comprised of four directors, each director meets the Nasdaq independence requirements and all four directors qualify as “non-employee directors” under the Securities Exchange Act of 1934, as amended (“Exchange Act”).

The Compensation Committee has the authority, in its sole discretion, to retain a compensation consultant, legal counsel or other advisers, and are directly responsible for the compensation, retention terms and overseeing the work of any such advisers.

The Compensation Committee engaged Frederic W. Cook & Co., Inc. (“FW Cook”) to serve as the compensation consultant for the Compensation Committee and to provide advice in connection with the design of the Company’s 2023 compensation program for directors and executive officers. FW Cook did not provide any other services to the Company or management, and FW Cook only received fees from the Company for the services it provided to the Compensation Committee. The Compensation Committee evaluated FW Cook’s independence under the applicable Nasdaq and SEC standards and concluded that FW Cook was independent of the Company and that its services raised no conflicts of interest. The Company’s Chief Executive Officer, Chief Financial Officer, and Chief People Officer were invited to participate in discussions regarding the 2023 compensation program and to give their recommendations.

| |

| Proxy Statement and Annual Meeting Report 2024 |

11 |

CORPORATE GOVERNANCE

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | ||

|

MEMBERS Claire Spofford (Chair) Yolanda Daniel Seth Estep |

PRINCIPAL RESPONSIBILITIES:

The primary role of the Nominating and Corporate Governance Committee is to assist the Board with oversight of the director nominations process and the Company’s corporate governance.

We have adopted a committee charter, which details the purpose and responsibilities of the Nominating and Corporate Governance Committee, including:

• identifying, evaluating, and selecting, or making recommendations to our Board regarding, nominees for election to our Board and its committees;

• evaluating the performance of our Board and of individual directors;

• considering and making recommendations to our Board regarding the composition of our Board and its committees;

• reviewing developments in corporate governance practices;

• evaluating the adequacy of our corporate governance practices and reporting;

• reviewing the succession planning for our executive officers; and

• developing and making recommendations to our Board regarding corporate governance guidelines and matters.

The Board has delegated to the Nominating and Corporate Governance Committee oversight of our ESG matters. The Nominating and Corporate Governance Committee has an ESG Sub-Committee which reviews and monitors our ESG sustainability and corporate governance trends, and conducts ESG shareholder outreach.

The Nominating and Corporate Governance Committee may delegate its duties and responsibilities to one or more subcommittees, consisting only of independent directors, as it determines appropriate.

The Nominating and Corporate Governance Committee is comprised of four directors and each director meets the Nasdaq independence requirements.

The Nominating and Corporate Governance Committee has the authority to retain counsel and other advisers as it determines necessary to fulfill its duties and responsibilities, including search firms to be used to identify director candidates. The Nominating and Corporate Governance Committee is responsible for setting the compensation and retention terms and overseeing the work of any director search firm, outside legal counsel or any other advisors.

| |

| 12 Leslie’s, Inc. |

CORPORATE GOVERNANCE

RISK OVERSIGHT

A core responsibility of the Board is to understand the principal risks associated with the Company’s business on an ongoing basis, and oversee the key risk decisions of management, which includes comprehending the appropriate balance between risks and rewards. While the Audit Committee has primary responsibility for risk oversight, both the Audit Committee and the Board are actively involved in risk oversight and both receive reports on our risk management activities from our executive management team on a regular basis. Members of both the Audit Committee and the Board also engage in periodic discussions with members of management as they deem appropriate to review and address the proper management of the Company’s risks. In addition, each committee of the Board considers risks associated with its respective area of responsibility.

COMMUNICATIONS WITH DIRECTORS

Shareholders may contact the Board, including to recommend director candidates, by mailing correspondence “c/o Corporate Secretary” to the Company’s principal offices at 2005 East Indian School Road, Phoenix, Arizona 85016. Correspondence will be forwarded to the respective director, except that director candidate recommendations will be forwarded to the Nominating and Corporate Governance Committee. In addition, the Corporate Secretary reserves the right not to forward advertisements or solicitations, customer complaints, obscene or offensive items, communications unrelated to the Company’s affairs, business or governance, or otherwise inappropriate materials.

GOVERNANCE DOCUMENTS

The Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee each operate pursuant to written charters adopted by the Board. These charters, along with the Corporate Governance Guidelines and the Code of Ethics, are available at the Company’s website and in print to any shareholder who requests a copy. To access these documents from the Company’s website, go to ir.lesliespool.com and select “Governance Documents” from the “Governance” drop-down menu. Requests for a printed copy should be addressed to Corporate Secretary, Leslie’s, Inc., 2005 East Indian School Road, Phoenix, Arizona 85016.

| Proxy Statement and Annual Meeting Report 2024 |

13 |

CORPORATE GOVERNANCE

POLICIES PROHIBITING HEDGING OR PLEDGING

The Board has adopted a policy prohibiting all executive officers and directors from engaging in any form of hedging transaction involving the securities of the Company. The policy addresses short sales and transactions involving publicly traded options and also prohibits such individuals from holding our securities in margin accounts and from pledging our securities as collateral for loans. We believe that these policies further align our executives’ interests with those of our shareholders.

DIRECTOR COMPENSATION

The Board reviews the Company’s director compensation program annually with the assistance of FW Cook. Board compensation is reviewed in relation to the same peer group used to benchmark the executive compensation program and with reference to the market median to ensure that directors are paid competitively for their time commitment. The following table sets forth the compensation earned by our non-employee directors for service as a member of the Board for the fiscal year ended September 30, 2023. Mr. Estep does not appear in the table below as he did not join the Board until after the end of the fiscal year ended September 30, 2023.

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

All Other Compensation ($)(2) |

Total ($) | ||||||||||||

| Yolanda Daniel |

85,000 | 125,000 | - | 210,000 | ||||||||||||

| Jodeen Kozlak(3) |

38,764 | - | - | 38,764 | ||||||||||||

| Eric Kufel |

70,000 | 125,000 | - | 195,000 | ||||||||||||

| Marc Magliacano(3) |

29,643 | - | - | 29,643 | ||||||||||||

| Susan O’Farrell |

95,000 | 125,000 | 9,464 | 229,464 | ||||||||||||

| Steven L. Ortega |

125,000 | 125,000 | 10,212 | 260,212 | ||||||||||||

| James Ray. Jr.(4) |

112,720 | 125,000 | - | 237,720 | ||||||||||||

| Claire Spofford |

85,000 | 125,000 | - | 210,000 | ||||||||||||

| John Strain |

95,000 | 125,000 | 3,981 | 223,981 | ||||||||||||

| (1) | The amounts in this column reflect the aggregate grant date fair value of the restricted stock units (“RSUs”) granted to our nonemployee directors during the fiscal year, computed in accordance with Accounting Standards Codification 718. The valuation assumptions used in determining such amounts are described in Note 17 – Equity-Based Compensation to our consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended September 30, 2023. The grant dates for the RSUs for all non-employee directors were March 15, 2023. |

| (2) | The amounts in this column reflect the portion of health insurance premiums paid by the Company. All directors are eligible to participate in the health plans generally provided to our executives (provided that they pay the same portion of the premiums, related deductibles, and copays as required to be paid by our actively employed executives). |

| (3) | Ms. Kozlak received prorated fees for her time on the Board prior to her not standing for reelection at the 2023 Annual Meeting on March 16, 2023. In addition, Mr. Magliacano received prorated fees for his time on the Board prior to his resignation at the conclusion of the 2023 Annual Meeting on March 16, 2023. |

| (4) | Mr. Ray resigned from the Board effective December 18, 2023. |

| 14 Leslie’s, Inc. |

CORPORATE GOVERNANCE

Our non-employee directors are eligible to receive cash compensation for their service on our Board and committees in the form of annual cash retainers as follows.

| Position |

Retainer ($) | |||

| Non-Executive Chairman |

125,000 | |||

| Board Member (other than the Non-Executive Chairman) |

75,000 | |||

| Lead Independent Director |

25,000 | |||

| Audit Committee: |

||||

| Chairperson |

25,000 | |||

| Committee Member |

10,000 | |||

| Compensation Committee: |

||||

| Chairperson |

15,000 | |||

| Committee Member |

10,000 | |||

| Nominating and Corporate Governance Committee: |

||||

| Chairperson |

10,000 | |||

| Committee Member |

5,000 | |||

Equity Compensation. Upon initial election and re-election to our Board, our non-employee directors receive an award of RSUs, with the number of shares determined by dividing $125,000 by the closing price of our common stock on the date of the grant. All RSUs granted to our non-employee directors vest on the earlier of the one-year anniversary date from the grant date or the day prior to the Company’s next annual meeting. For grants made in connection with a director’s initial election or appointment to our Board, the $125,000 dollar amount is pro-rated based on the number of days remaining in the 365-day period following the last annual meeting.

Expense Reimbursement. Our directors will be reimbursed for travel, food, lodging and other expenses directly related to their activities as directors. Our directors are also entitled to the protection provided by the indemnification provisions in our bylaws. Our Board may revise the compensation arrangements for our directors from time to time.

Share Ownership. Our Board believes that, in order to more closely align the interests of our non-employee directors with the long-term interests of the Company’s shareholders, all non-employee directors should maintain a minimum level of equity interests in the Company’s common stock. Such stock ownership guidelines are based on the value of common stock owned as a multiple of the non-employee director’s retainer. For a non-employee director, the stock ownership multiple is 5x their annual cash retainer. The guidelines will be reviewed annually and revised as appropriate to keep pace with competitive and good governance practices. For purposes of determining stock ownership levels, the following forms of equity interests in the Company are included: common stock of the Company; Company restricted stock or RSUs granted under the Company’s 2020 Omnibus Incentive Plan (or any predecessor or successor plan) which are to be settled in shares of common stock, except to the extent such restricted stock or RSUs are subject to vesting conditions other than conditions based solely on the passage of time and continued service. Under the guidelines, non-employee directors are required to hold 50% of the net shares resulting from stock option exercises or vesting of other stock-based awards until they reach the applicable level. As of the record date, all non-employee directors were in compliance with the guidelines either by virtue of holding the required number of shares or by compliance with the 50% retention ratio.

| Proxy Statement and Annual Meeting Report 2024 |

15 |

Proposal 1: Election of Directors

Our Certificate of Incorporation specifies that the Board currently consists of three classes of directors serving staggered three-year terms. There are three Class III directors whose term of office expires at the 2024 Annual Meeting of Shareholders (the “Annual Meeting”). Based on the recommendation of the Nominating and Corporate Governance Committee, the Board nominated three Class III directors for election at the Annual Meeting to hold office until the 2027 annual meeting of our shareholders or until their successors have been elected and qualified, or his or her earlier death, resignation, retirement, disqualification or removal. In accordance with the Certificate of Incorporation, all directors, including directors elected at this Annual Meeting, will stand for election to a one-year term at the 2027 Annual Meeting.

Each of the nominees standing for election at the Annual Meeting has consented to serve as a director, if elected, and all of the nominees are currently directors. Steven L. Ortega, a Class III director, notified the Company that he is not standing for re-election at the Annual Meeting and the size of the Board will be reduced from eight to seven directors effective as of the Annual Meeting. We have no reason to believe that any of the nominees will be otherwise unavailable or, if elected, will decline to serve. If any nominee becomes unable or unwilling to stand for election as a director, proxies will be voted for any substitute as designated by the Board, or alternatively, the Board may further reduce the size of the Board.

|

Our Board recommends a vote “FOR” the election of each nominee.

|

|||

| 16 Leslie’s, Inc. |

PROPOSAL 1: ELECTION OF DIRECTORS

DIRECTOR NOMINEES

For each of the three director nominees standing for election, as well as the four other directors with terms expiring at future annual meetings, the following describes certain biographical information and the specific experience, qualifications, attributes or skills that qualify them to serve as our directors and, as applicable, the Board committees on which they serve.

NOMINEES FOR ELECTION TO A THREE-YEAR TERM EXPIRING AT THE 2027 ANNUAL MEETING OF SHAREHOLDERS

In accordance with the Certificate of Incorporation, all members of the Board, including directors elected at this Annual Meeting, will stand for re-election to a one-year term at the 2027 Annual Meeting.

In addition, Steven L. Ortega, a Class III director, notified the Company that he is not standing for re-election at the Annual Meeting and the size of the Board will be reduced from eight to seven directors effective as of the Annual Meeting.

Skills and Experience

| • Retail/Merchandising

• Strategic Management

• Supply Chain

• Human Capital

• Information Technology |

• Finance/Accounting

• Governance/Risk Management

• Senior Leadership

• Public Company Experience |

| Other Public Company Boards | Committees | |

| Savers Value Village, Inc. (NYSE: SVV) |

• Audit (Chair) |

Background

Ms. O’Farrell joined the Board in October 2020. Previously, Ms. O’Farrell served as Chief Financial Officer, Senior Vice President, Principal Accounting Officer and Treasurer at BlueLinx Holdings Inc., a wholesale distributor of building and industrial products, from 2014 to 2020. Ms. O’Farrell has been a senior financial executive holding several roles with The Home Depot, a home improvement retailer, from 1999 to 2014. As the Vice President of Finance at The Home Depot, Ms. O’Farrell led teams supporting the retail organization. In her final role with The Home Depot, Ms. O’Farrell was responsible for the finance function for The Home Depot’s At Home Services Group. Ms. O’Farrell began her career with Andersen Consulting, LLP, leaving as an Associate Partner in 1996 for a strategic information systems role with AGL Resources. Ms. O’Farrell served as a Director of BlueLinx Corporation, a subsidiary of BlueLinx Holdings. Ms. O’Farrell currently serves on the board of directors of Savers Value Village, Inc. (NYSE: SVV), since 2023. Ms. O’Farrell has a B.S. in business administration from Auburn University. Ms. O’Farrell was selected to serve as a director due to her extensive leadership experience in the retail and distribution industry, her broad business background, financial expertise as well as her experience as the Chief Financial Officer of a publicly listed company.

| Proxy Statement and Annual Meeting Report 2024 |

17 |

PROPOSAL 1: ELECTION OF DIRECTORS

Skills and Experience

|

• Retail/Merchandising

• Strategic Management

• Brand and Consumer Marketing

• Human Capital Management |

• Governance/Risk Management

• Senior Leadership

• Public Company Experience

• ESG/DEI |

| Other Public Company Boards | Committees | |

| J. Jill, Inc. (NYSE: JILL) | • Nominating and Corporate Governance (Chair)

• Compensation |

Background

Ms. Spofford joined the Board in May 2022. Ms. Spofford currently serves as Chief Executive Officer and President of J. Jill, a women’s apparel company. She also serves on J.Jill’s board of directors. Prior to joining J.Jill in February 2021, Ms. Spofford was the President of Cornerstone Brands, from December 2017 to October 2020. In that role, she oversaw a portfolio of four interactive, aspirational, home and apparel lifestyle brands: Ballard Designs, Frontgate, Garnet Hill and Grandin Road. She led the team there in evolving the brands into profitable, digitally-driven omnichannel businesses. Before being promoted into this role, from January 2014 to December 2017, Ms. Spofford was the President of Garnet Hill. Prior to that, Ms. Spofford was Senior Vice President and Chief Marketing Officer of J.Jill and held numerous leadership roles at Orchard Brands, including Interim President and Chief Executive Officer, Group President for Premium Brands, and President of Appleseed’s. Before joining Orchard Brands, Spofford served as Vice President, Global Marketing of Timberland. Ms. Spofford currently serves on the board of directors of Reclaim Childhood, and she previously served on the boards of White Flower Farm and Project Adventure, Inc. Ms. Spofford received her M.B.A. from Babson College and her Bachelor of Arts in English and Political Science from the University of Vermont.

Skills and Experience

| • Retail/Merchandising

• Strategic Management

• Supply Chain

• Human Capital Management

• Brand and Consumer Marketing

• Finance/ Accounting |

• Governance/Risk Management

• Senior Leadership

• Public Company Experience |

| Other Public Company Boards | Committees | |

| None | • Nominating and Corporate Governance

• Compensation |

Background

Mr. Estep, age 44, has served as Executive Vice President, Chief Merchandising Officer of Tractor Supply Company (NASDAQ: TSCO) since February 2020 and as a member of Tractor Supply Company’s Executive Committee since June 2019. He brings nearly 20 years of experience in retail, with deep expertise in merchandising, pricing, product development, sourcing and private brands. Prior to his current role, Mr. Estep served as Senior Vice President, General Merchandising from 2017 to 2020. He joined Tractor Supply in 2008, and held a number of merchandising roles of increasing seniority and responsibility at the company from 2008 to 2017. Mr. Estep also oversaw management of Petsense by Tractor Supply, a pet specialty retailer owned and operated by Tractor Supply, from 2020 to 2021. Mr. Estep holds a bachelor’s degree from the University of Tennessee and an MBA in Finance from Belmont University.

| 18 Leslie’s, Inc. |

PROPOSAL 1: ELECTION OF DIRECTORS

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2025 ANNUAL MEETING OF SHAREHOLDERS

In 2023 we commenced the declassification of our Board with the implementation of the Certificate of Incorporation. In accordance with the Certificate of Incorporation, directors with terms expiring at our 2025 Annual Meeting will stand for re-election to a two-year term at the 2025 Annual Meeting, and beginning with our 2027 Annual Meeting, all directors will be elected to a one-year term.

Skills and Experience

| • Strategic Management

• Supply Chain

• Finance/Accounting

• Governance/Risk Management |

• Senior Leadership

• ESG/DEI

• Public Company Experience |

| Other Public Company Boards | Committees | |

| None | • Audit

• Nominating and Corporate Governance |

Background

Ms. Daniel joined the Board in October 2020. Ms. Daniel is the former Vice President, Finance of the Federal Reserve Bank of Chicago where between 2017 through 2022 she was responsible for finance, financial analytics, procurement and supplier diversity. The Federal Reserve Bank of Chicago is one of twelve regional reserve banks that, along with the Federal Reserve Board of Governors, make up the United States central bank. Ms. Daniel brings 30 years of finance, accounting and audit experience and executive leadership in the global and domestic distribution, financial services, and healthcare industries. Ms. Daniel previously served as CFO for mission-based organizations from 2015 to 2017, which included her tenures at IFF, a community development financial institution and real estate developer, where she led the finance and investor relations functions, as well as tenure at the American Board of Medical Specialties. In the preceding 15 years, Ms. Daniel held senior financial executive roles in industry which included a seven-year tenure at W. W. Grainger, Inc. as Global Chief Audit Executive, CFO and Board Director for Grainger Canada, a division of W.W. Grainger, Inc., and Vice President for finance transformation and, U.S. financial services, where she led the company’s U.S. payment operations. Ms. Daniel also held roles of increasing responsibility at CVS Health (formerly Caremark), where, as Vice President, internal audit services she was responsible for attestation and consultation activities during a highly acquisitive and extensive growth period for the company. Ms. Daniel began her finance career in public accounting in 1990 with Banks, Finley, White & Company leaving in 1994 to assume progressive roles in finance leadership with private equity and small businesses. Ms. Daniel earned an MBA from Kellogg School of Management at Northwestern University, B.S. in accounting from the University of Alabama at Birmingham, and is a marketing alumna from Jackson State University. Ms. Daniel is actively engaged in non-profit leadership, is an Aspen Institute 2017 Finance Leaders Fellow, and a member of the Aspen Global Leadership Network. Ms. Daniel was selected to serve on our Board because of her significant experience in finance and accounting, as well as her audit leadership for global and US-based operations across the distribution, financial services, and healthcare industries.

| Proxy Statement and Annual Meeting Report 2024 |

19 |

PROPOSAL 1: ELECTION OF DIRECTORS

Skills and Experience

| • Retail/Merchandising

• Strategic Management

• Brand and Consumer Marketing

• Digital Commerce and Marketing

• Human Capital Management |

• Finance/Accounting

• Governance/Risk Management

• Senior Leadership

• Public Company Experience |

| Other Public Company Boards | Committees | |

| None | None |

Background

Mr. Egeck is our Chief Executive Officer and a member of our Board. Mr. Egeck joined in such capacities in February 2020. Previously, Mr. Egeck served as the Chief Executive Officer of PSEB Group, a $1.5 billion operating company composed of the Eddie Bauer outdoor brand and teen retailer PACSUN. Mr. Egeck has more than three decades of experience and a proven track record of driving transformational growth for a variety of brands and business models including: Chief Executive Officer of Eddie Bauer (from 2012 to 2020); Chief Executive Officer of Hurley International, a division of Nike, Inc. (from 2011 to 2012); President of True Religion Apparel, Inc. (from 2010 to 2011); President of VF Corp’s Contemporary Brand Coalition (from 2007 to 2009); Chief Executive Officer of Seven For All Mankind, prior to its acquisition by VF Corp. (from 2006 to 2007); President of VF Corp’s Outdoor and Action Sports Coalition (from 2004 to 2006); and President of The North Face, a division of VF Corp (from 2000 to 2004). Previously, Mr. Egeck held senior leadership positions at Columbia Sportswear and Seattle Pacific Industries. Mr. Egeck has a B.A. in Economics from the University of Washington and an M.B.A. from the Michael G. Foster School of Business at the University of Washington. Mr. Egeck was selected to serve on our Board because of his experience and knowledge of the consumer industry, including as our Chief Executive Officer.

Skills and Experience

| • Retail/Merchandising

• Strategic Management

• Supply Chain

• Brand and Consumer Marketing

• Digital Commerce and Marketing |

• Human Capital Management

• Governance/Risk Management

• Senior Leadership

• Public Company Experience |

| Other Public Company Boards | Committees | |

| None | None |

Background

Mr. Kufel joined the Board in January 2018 and served as our Executive Chairman from January 2019 through September 2019. Mr. Kufel is the former Chief Executive Officer of West Marine, Inc., a retailer of boating and fishing supplies, and held such role from August 2021 through December 2022. Previously, Mr. Kufel served as Chairman of CorePower Yoga from 2016 to 2020 and as its Chief Executive Officer from 2016 to 2019. From 2015 to 2016, Mr. Kufel was an Operating Partner at L Catterton and served on the board of Ferrara Candy Company. Mr. Kufel also served as a Director and the Chief Executive Officer of Van’s Foods from 2009 to 2014 and Inventure Foods, Inc. from 1997 to 2008. Mr. Kufel has a Bachelor of Business Administration Degree from Gonzaga University and a master’s degree from the Thunderbird School of Global Management. Mr. Kufel was selected to serve as a director due to his extensive experience in leadership roles in the consumer industry.

| 20 Leslie’s, Inc. |

PROPOSAL 1: ELECTION OF DIRECTORS

DIRECTORS CONTINUING IN OFFICE UNTIL THE 2026 ANNUAL MEETING OF SHAREHOLDERS

In 2023 we commenced the declassification of our Board with the implementation of the Certificate of Incorporation. In accordance with the Certificate of Incorporation, directors with terms expiring at our 2026 Annual Meeting will stand for re-election to a one-year term at the 2026 Annual Meeting, and beginning with our 2027 Annual Meeting, all directors will be elected to a one-year term.

Skills and Experience

| • Retail/Merchandising

• Strategic Management

• Digital Commerce and Marketing

• Human Capital Management

• Information Technology and Cyber Security |

• Finance/Accounting

• Governance/Risk Management

• Senior Leadership

• Public Company Experience |

| Other Public Company Boards | Committees | |

| None | • Audit

• Compensation (Chair) |

Background

Mr. Strain joined the Board in August 2018. Mr. Strain was the Head of e-Commerce and Technology at Gap, Inc., between October 2019 and May 2022. Gap, Inc. is an American worldwide clothing and accessories retailer founded in 1969. Mr. Strain had responsibilities in such role for technology, product management, data and analytics, and loyalty and payments. Mr. Strain also oversaw the digital business including e-commerce strategy and operations and digital and direct marketing. With almost 30 years in the retail technology and e-commerce space, Mr. Strain brings a consumer-centric mindset to a delivery orientation that has resulted in a track record of successful digital transformations. Prior to joining Gap Inc., Mr. Strain was the General Manager of the Retail and Consumer Goods Industry for Salesforce. Mr. Strain also spent 11 years at Williams-Sonoma Inc. as the Chief Digital and Technology Officer, where he was responsible for technology, product management, and digital marketing. Mr. Strain also spent 14 years as a management consultant. Mr. Strain received a B.S. in Finance from Santa Clara University where he was a member of the Retail Management Institute. Mr. Strain was selected to serve as a director due to his experience in various positions with consumer-facing companies.

| Proxy Statement and Annual Meeting Report 2024 |

21 |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm

Ernst & Young LLP (“EY”) has served as the Company’s independent registered public accounting firm since 2000. Representatives of EY are expected to be present at the Annual Meeting online and will have an opportunity to make a statement if they wish and be available to respond to appropriate questions from shareholders.

We are asking shareholders to ratify the Audit Committee’s selection of EY as our independent registered public accounting firm for the fiscal year ending September 28, 2024. While such ratification is not required, the Board is submitting the selection of EY to our shareholders for ratification as a matter of good corporate practice. If shareholders do not ratify the selection of EY as our independent registered public accounting firm for the fiscal year ending September 28, 2024, our Audit Committee may reconsider the selection of EY as our independent registered public accounting firm. Even if the selection is ratified, the Audit Committee may, in its discretion, select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our shareholders.

|

|

Our Board recommends a vote “FOR” the ratification of the selection by the Audit Committee of EY as our independent registered public accounting firm.

|

FEES PAID TO THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The following is a summary of fees paid or to be paid to EY for services rendered over the prior two fiscal years. All such services were pre-approved by our Audit Committee in accordance with the “Pre-Approval Policy” described below.

| For the Year Ended September 30, 2023 |

For the Year Ended October 1, 2022(3) |

|||||||

| Audit Fees(1) |

$2,825,000 | $2,195,000 | ||||||

| Audit-Related Fees |

- | - | ||||||

| Tax Fees |

- | - | ||||||

| All Other Fees(2) |

4,300 | 2,000 | ||||||

| Total |

$2,829,300 | $2,197,000 | ||||||

| (1) | Audit fees consist of fees associated with (i) the audits of our consolidated financial statements, (ii) reviews of our interim quarterly consolidated financial statements and (iii) assistance with SEC filings including consents and related services in connection with the Company’s offerings. |

| (2) | All other fees consist of license fees for EY’s accounting research software. |

| (3) | Audit fees include an invoice received from EY in 2023 that relate to services for the fiscal year 2022 audit. |

PRE-APPROVAL POLICY

The Audit Committee has adopted policies and procedures with respect to the pre-approval of all audit and permitted non-audit services by the Company’s independent registered public accounting firm. The Audit Committee undertakes a review of such policies at least quarterly, and if necessary, modifies such pre-approval procedures and policies. The Audit Committee may delegate its pre-approval responsibilities to one or more subcommittees as the Audit Committee may deem appropriate, provided that any pre-approval of services by such subcommittees pursuant to this delegated authority must be presented to the full Audit Committee at its next scheduled meeting.

| 22 Leslie’s, Inc. |

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

AUDIT COMMITTEE REPORT(1)

The Audit Committee has reviewed and discussed our audited financial statements with management, and has discussed with our independent registered public accounting firm the matters required to be discussed by applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and SEC. Additionally, the Audit Committee has received the written disclosures and the letter from our independent registered public accounting firm, as required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the independent registered public accounting firm’s independence. Based upon such review and discussion, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the last fiscal year for filing with the SEC.

Submitted by:

Audit Committee of the Board of Directors

Susan O’Farrell (Chair)

Yolanda Daniel

John Strain

| (1) | The information contained in this Audit Committee Report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of Exchange Act, except to the extent that the Company specifically requests that the information be treated as soliciting material or specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended (“Securities Act”) or the Exchange Act. |

| Proxy Statement and Annual Meeting Report 2024 |

23 |